Indian startups continue to burn cash as they chase growth. Registering growth akin to 1mg, e-pharmacy company Medlife has recorded 2.7X growth in FY19.

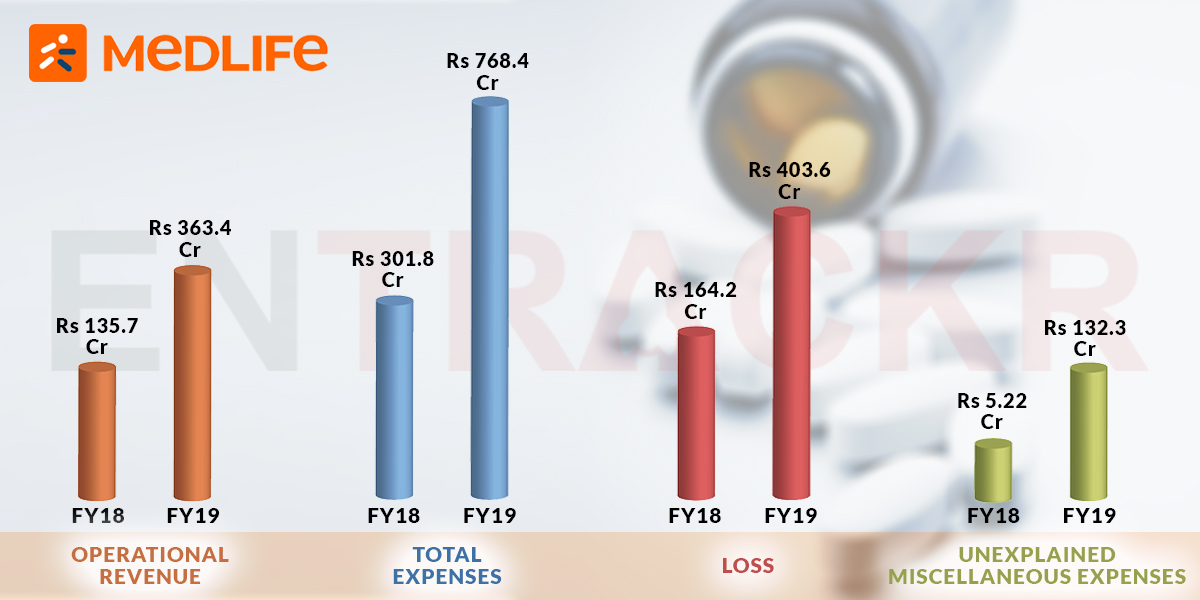

According to its regulatory filings with the MCA, the company’s operating revenue grew to Rs 363.4 crore in the year ending March 2019 from Rs 135.7 crore in FY18. Its expenditure and losses also grew at a similar pace.

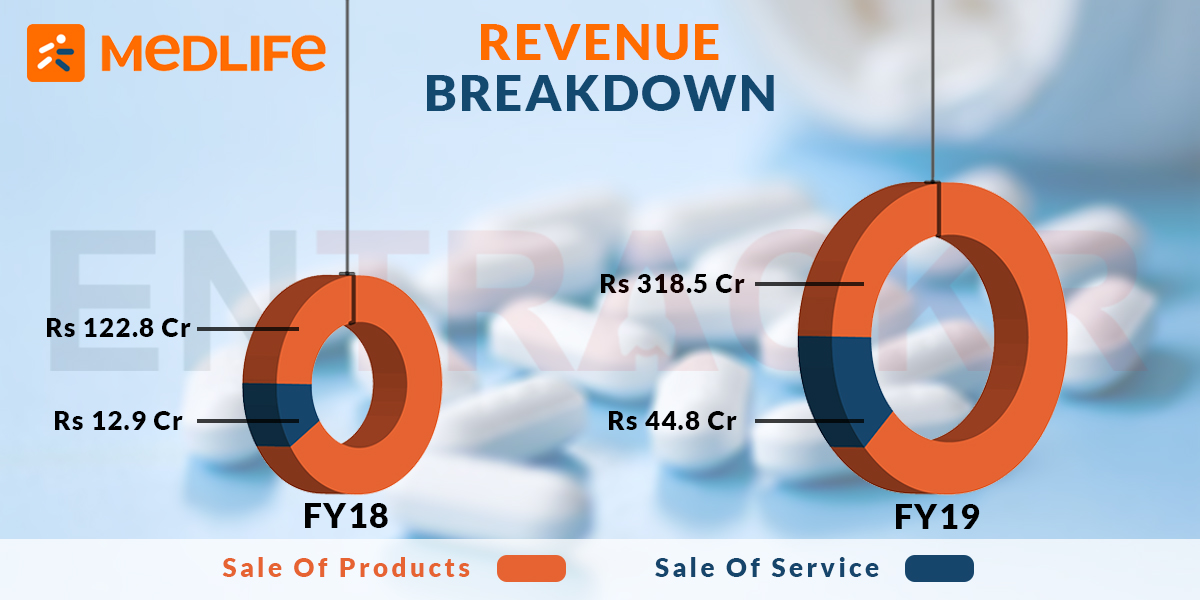

As for the firm’s revenue, almost 88% of it was generated through the sale of goods. It collected about Rs 318.5 crore from the sale of medicines and related products. This is 2.5X more than FY18 when Medlife sold Rs 123 crore worth of medicines.

The remaining Rs 44.84 crore of revenue has flowed in from providing lab and online consultation services in FY19, growing 3.5X from Rs 13 crore in FY18 — a sector the company is strongly foraying into.

To fulfill the increased demand, the company has also increased its spending on its inventory of goods. The purchase of stock in trade increased 2.5X to Rs 349 crore during FY19 from Rs 140.4 crore in FY18 and remained the biggest expense item for the company during the said year.

The company saw its inventories swell by Rs 40.7 crore during the year which stood at around Rs 60 crore at the end of FY19,

To bolster its revenues, Medlife splurged a substantial amount on advertising campaigns across print and media. Such expenses added up to Rs 128 crore in FY19, growing 3.66X from Rs 35 crore it spent during FY18.

Further, employee benefit expenses also increased by a significant amount – by 92% to reach Rs 107.6 crore in FY19 from Rs 56 crore in FY18. Legal expenses doubled to Rs 10.83 crore during the same time.

Interestingly, there’s been a striking increase in expenses categorized under the unexplained miscellaneous expenses. They grew dramatically by 24.3X to Rs 132.3 crore in FY19 from a mere Rs 5.22 crore in FY18.

Overall, the total expenditure for Medlife in FY19 was Rs 768.4 crore — increasing 2.54X from around Rs 302 crore it spent in FY18.

Losses too grew at a similar rate to reach Rs 403.6 crore in FY19 from Rs 164.2 crore in FY18.

The increased cash burn to grow scale was evident from the change in Medlife’s net cash outflow from operations, which swelled to Rs 425.11 crore in FY19, increasing 2.3X from Rs 185.3 crore in FY18.

Even while the scale of expenses ballooned, Medlife saw its unit economics improve marginally as it spent Rs 2.1 to generate a rupee of operating revenue in FY19 as compared to Rs 2.22 it spent for the same during FY18.

The company employed the synergies of the Medlife group and sourced products and services from related parties including Tulip Lab Pvt Ltd, Prashanth Packaging Industries, Prasant Packaging Pvt Ltd, Safe Life Enterprises Pvt Ltd and Rajani Paper products to gain a competitive advantage over its rivals in the e-pharmacy market.

Akin to Medlife, its rival 1mg earns 65% of its total operating revenues from the sale of medical products and not medicines. The company operates on a similar business model and carries a significant inventory of medicines, which has now been disallowed by the Health Ministry’s revised draft regulations restricting e-pharmacies from maintaining an inventory and only allowing them to act as a marketplace.

While Medlife’s revenue growth has kept up with the rise in its expenses in FY19, the company has been grappling with uncertainty around the new directives.

Given that India is yet to finalize the regulation around the online sale of drugs, or e-pharmacies, the ongoing fiscal may prove to be a sluggish one for the company.

This year, the company is also expected to raise a new round of funding, talks for which have been on with multiple investors for a while now.

Former Myntra CEO Ananth Narayanan joined Medlife in August as its co-founder and chief executive. Apart from handling its day-to-day operations, he also deals with fundraising for the company.