Although a late entrant in the payment gateway business, Razorpay has managed to scale quickly. The company is one of the fastest-growing in the segment and along with quick growth, Razorpay has also been able to improve its financials drastically in FY19.

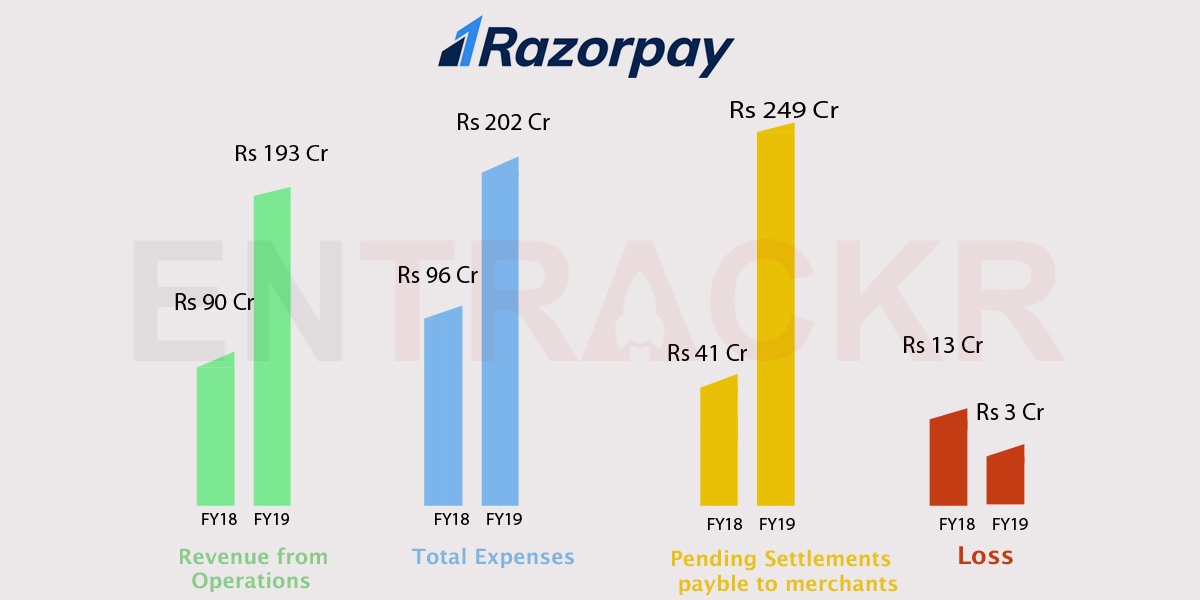

The company registered 2.14X growth in operating revenue and its losses shrunk by 74.5% in the year ending March 2019. According to regulatory filings with the MCA, the company’s earnings from the commission on the payment gateway service jumped to Rs 193.03 crore in FY19 from around Rs 90 crore in FY18.

Nearly 30% of the operating revenue, i.e. Rs 57.3 crore, was generated from its US-based parent entity. On the expenses front, the employee benefit component witnessed a jump of 2.2X to Rs 51.22 crore in FY19 from Rs 23.3 crore in FY18.

Spends on advertising and promotion also spiked 8.2X to Rs 3.7 crore in FY19 from Rs 45 lakhs in FY19.

Expenditure on banking and card networks were the biggest burn for the payment gateway firm with an increase of 2X and accounted for 64% of the total expenses. Such costs stood at Rs 129.12 crore.

The business growth was also reflected in the total expenses incurred by the company, which similar to revenue, grew 2.1X to Rs 202.15 crore in FY19 from Rs 95.7 crore in FY18.

While the total expenses surged, Razorpay has managed to control its losses by 74.5% to Rs 3.26 crore in FY19 from Rs 12.8 crore in FY18. Significantly, Razorpay also improved its operational efficiency along with the surge in scale as the net cash outflow from operations were reduced by 99% to only Rs 4.6 lakhs in FY19 from Rs 15.9 crore in FY18.

It’s highly likely the company can achieve the milestone of being cash flow positive if it follows up with the same level of efficiency in the ongoing fiscal.

Further, the amount payable to merchants pending settlement at the end of FY19 stood at nearly Rs 250 crore and it had accepted bills payable for the same. This largely because transactions processed on 31st March are settled the next day.

Overall current liabilities of the company witnessed a 5.9X jump and stood at Rs 283.03 crores, making up 99.3% of the total liabilities for the company. Current Ratio for the firm also degraded from 3.57 in FY18 to 1.37 FY19.

If we compare the payment gateway expenses incurred by Paytm during FY19, Razorpay’s books look healthy and efficient. Paytm’s expenses on payment gateway business increased in the tune of 87.12% in FY19. The SoftBank-backed company lost Rs 2615.34 crore in the payment gateway business alone.

Meanwhile, Paytm had an operating revenue of Rs 1,756 crore during FY19. Such staggering loss could be the impact of incurring MDR cost by Paytm on customer’s behalf as the firm bears the cost whenever a user recharges the wallet or transacts using Paytm Payments Bank.