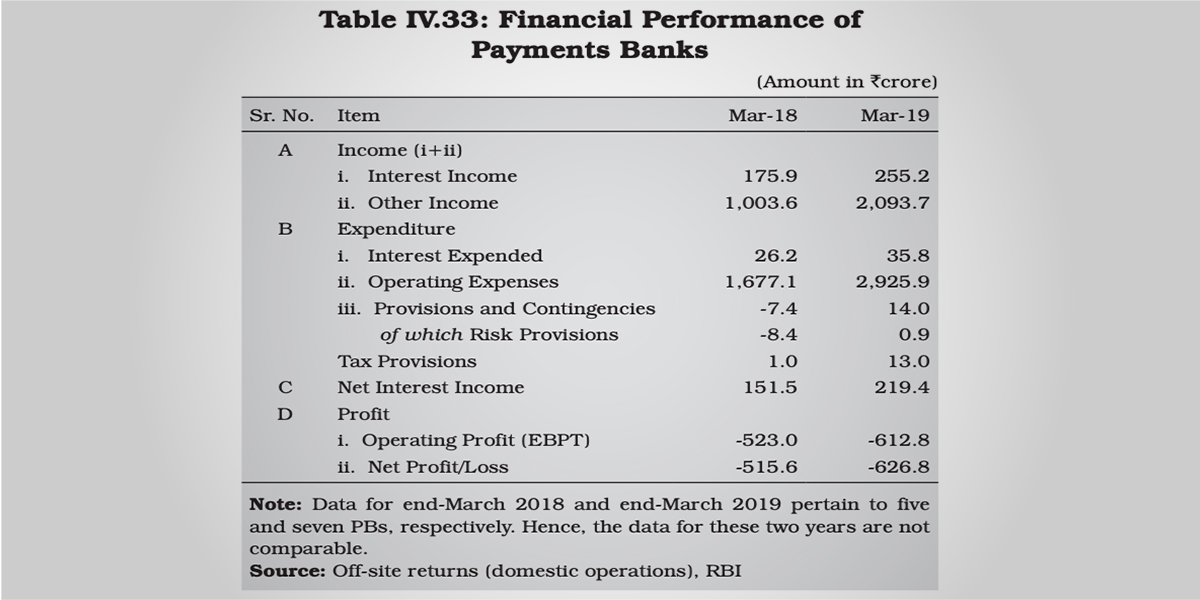

The cloud of uncertainty over the business model of payments bank (PB) in India continues to hover around. Despite an improvement in net interest income and non-interest income, payments banks aggregate losses increased 21% to Rs 626.8 crore in FY19 from Rs 516 crore in the previous year.

“The limited operational space available to them and the large initial costs involved in setting up the infrastructure imply that it may take time for PBs to break even as they expand their customer base,” said the RBI’s report on ‘Trend and Progress of Banking in India’.

Despite a couple of positives this fiscal, PBs are largely hampered by the limitations imposed on it.

PBs cannot undertake lending activities and their design is functionally equivalent to that of pre-paid instrument (PPI) providers which are permitted

to receive cash payments from customers, store them in a digital wallet, and allow customers to pay for goods and services from this wallet.

It is not allowed to collect more than Rs 1 lakh as a deposit from customers.

This fiscal, Interest income of payments banks increased by 45% to Rs 255 crore from the previous year, while other income doubled to Rs 2,093 crore this year from earlier. PBs remittances through payment banks increased 23% to Rs 1.10 lakh crore in fiscal 2019 from Rs 89,653 crore in fiscal 2018.

Payments banks saw their deposit base double in FY19 to Rs 883 crore from Rs 438 crore in FY18.

The number of UPI transactions increased to 499 million, worth Rs 57,219 crore that accounted for 70% of total transactions.

Besides in December, the RBI’s decision on NEFT allowed payment bank customers to perform transaction round the clock with increased transaction limit.

There are very few payments banks, who have achieved profitability in India. Paytm payment bank is one of them, which had started operations in late 2017 and claimed a profit of Rs 19 crore for the financial year ending on March 31, 2019.

In FY19, PPB revenue jumped 2.3X to Rs 1,668 crore from Rs 772 crore in FY18. It generated Rs 142.5 crore of this income through interest earned on government securities and the rest Rs 1525.5 crore or 91.5% through commission and brokerage earned on transactions.

Importantly, 86.7% of theses operational expenditures were incurred for availing payment gateway and customer access services availed from its parent One97 Communications.

The Alibaba-backed payment firm has also approached the government and RBI for a small finance bank licence to leverage the lending feature using technology-enabled low-cost operations.

Currently, out of eleven payments banks, only five (Paytm, Airtel, Fino, Jio and India Posts) are operational.