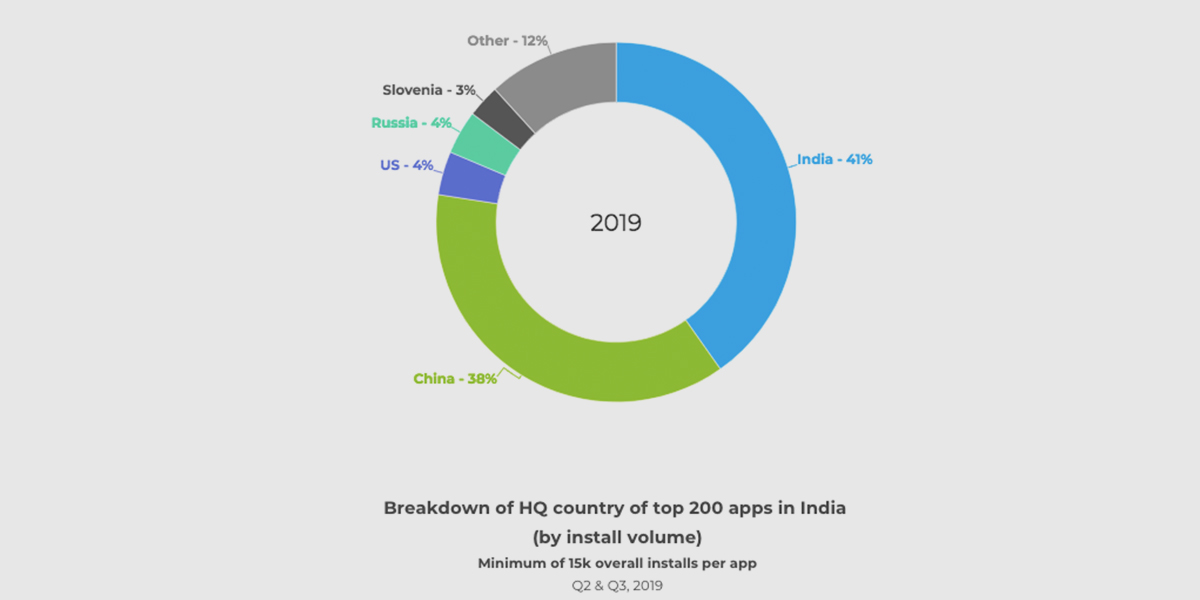

If 2018 belonged to Chinese apps in the Indian app market, 2019 belonged to the homegrown players who are gradually getting the momentum back in their favour.

According to an AppsFlyer study ‘State of App Marketing in India’, Indian apps as a whole recaptured their original standing as the largest group in the top 200 apps in India (by install volume) with a 41% share in 2019—up from 38% in 2018.

Domestic apps expanded on their already dominant position in the leading categories, including food and drink, shopping and travel in 2019.

Whereas the Chinese apps, which lead in categories such as gaming, news & entertainment and utilities, slipped to second place with a 38% share.

The Chinese and Indian apps altogether made up almost four-fifths (79%) of the list.

In the gaming segment, Chinese games such as Clash of Kings continue to dominate the list of India’s most popular mobile games, adding to their overall share to 20%, about 5% more than last year. Indian games had 12% of the market, added the study.

In the news and entertainment segment, Chinese apps like TikTok added significant numbers to claim 59% of the market in 2019, up 36% from last year.

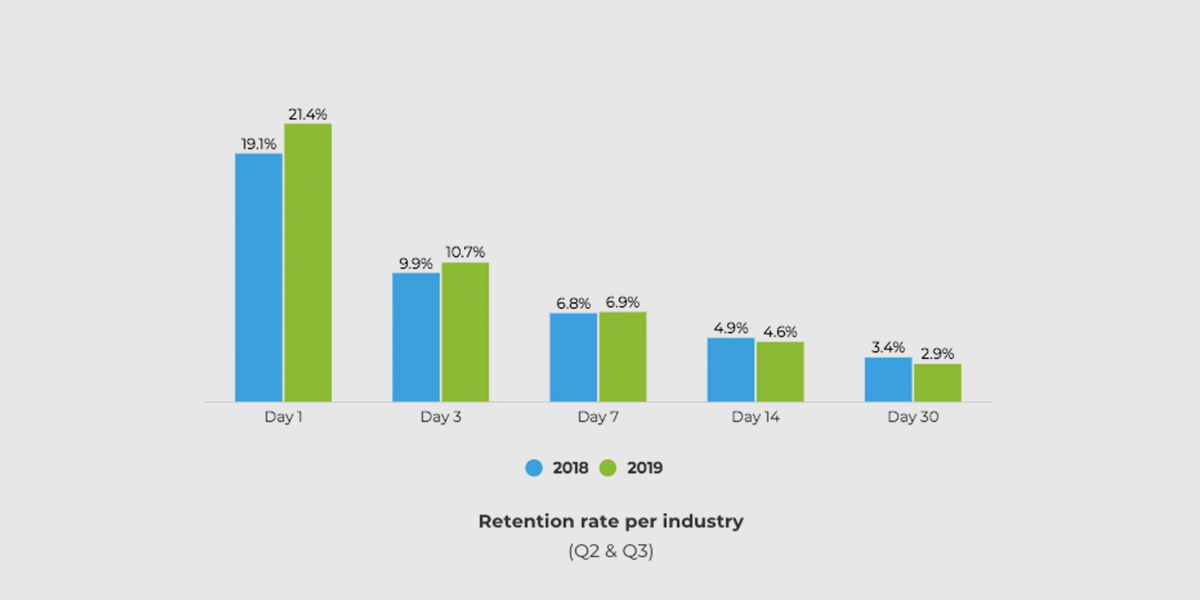

Compared to 2018, app retention rates also improved in 2019 due to both heightened spending and the increased number of hours that Indian users now spend on their mobile devices every day.

In 2019, apps score a 23.4% retention rate on Day 1 and a 2.6% retention rate by Day 30, a steady rise from 22.8% and 2.3% in 2018, respectively. Further, NOI (non-organic installs) in 2019 posted a retention rate of 26.2% on Day 1 and 3.3% on Day 30, even excelling that of organic installs (22.7% and 2.4%).

Users’ engagement with apps is also highest on the first day. According to AppsFlyer data, users who make in-app purchases within 30 days have a 45% probability of doing so in the first hour.

The non-organic install average per app overall grew by 38%, with the largest increases coming from finance, gaming and news & entertainment categories.

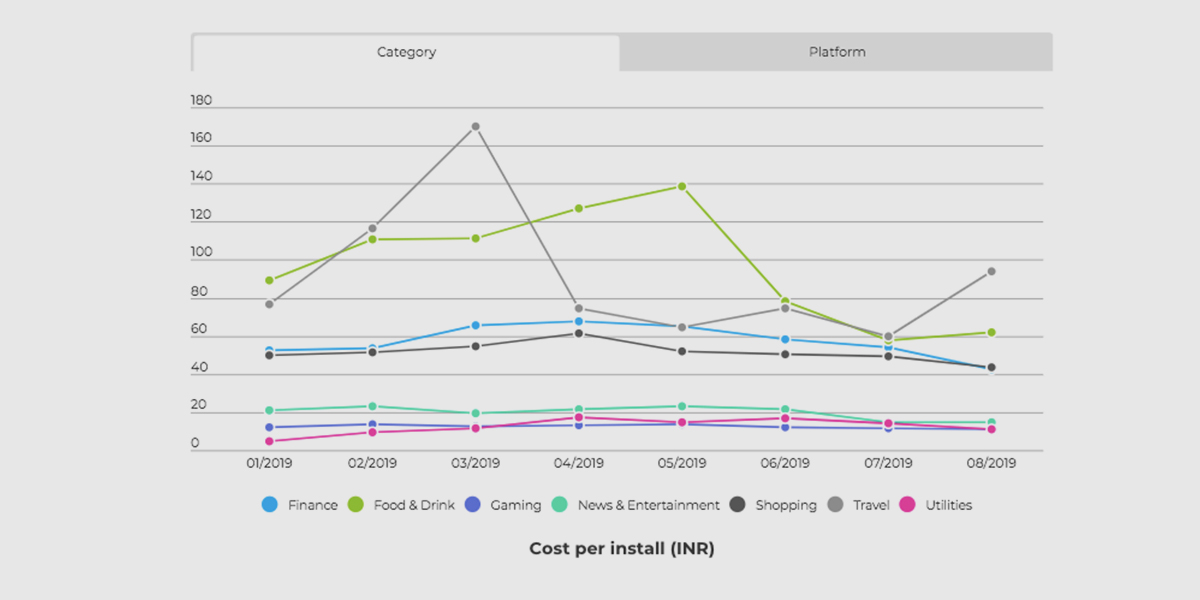

In terms of the acquisition cost, travel and food & drinks app users emerged as the most expensive to acquire, registering the highest cost per install (CPI) peak rates in 2019. Travel app developers spent an average of Rs 170.05 per user install this March, while food & drink app developers forked over Rs 138.48 per user this May.

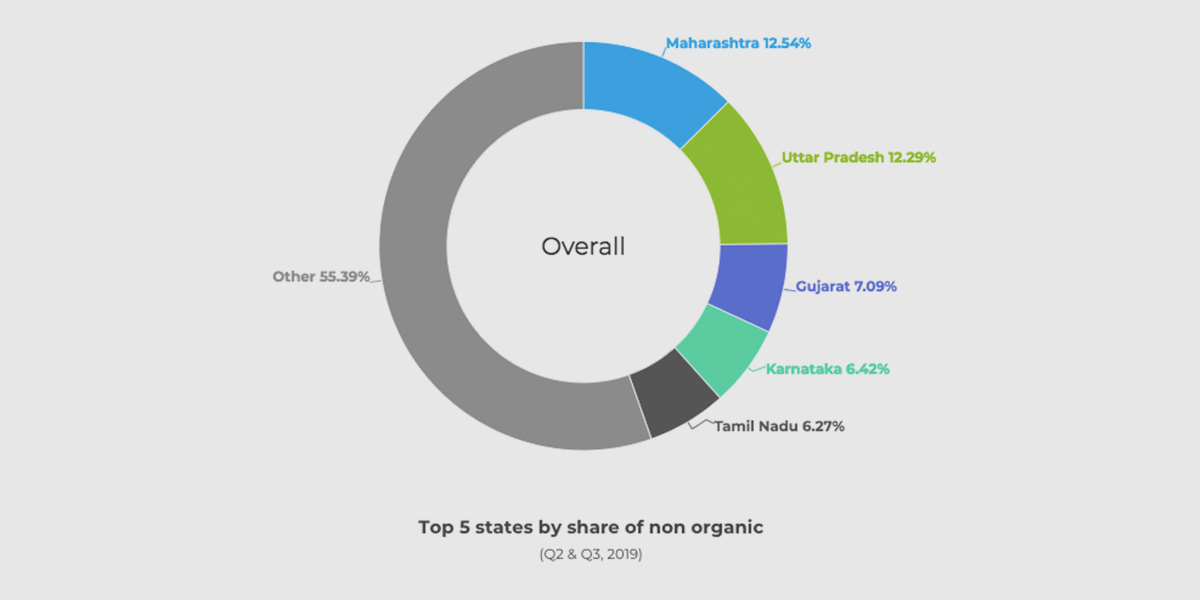

Across all categories, economic powerhouse Maharashtra led all states and union territories, followed closely by India’s most populous state Uttar Pradesh.

The data sample includes 7.8 billion apps opens from the second and third quarters of 2019 as well as 1.5 billion retargeting conversions. A total of 3,300 apps with at least 1,000 monthly non-organic installs were included in this study.