Online grocery startup Grofers, like many other e-commerce platforms in India, has a complex company structure. Its Indian operations are handled via two major entities — Grofers India Pvt Limited which handles the business support services and Hands-On Trades Private Limited which actually processes the wholesale purchase and sale of goods for the entity.

Both these firms are then controlled by Singapore-based Grofers Pte, which holds a 99.9% stake in each of the two companies.

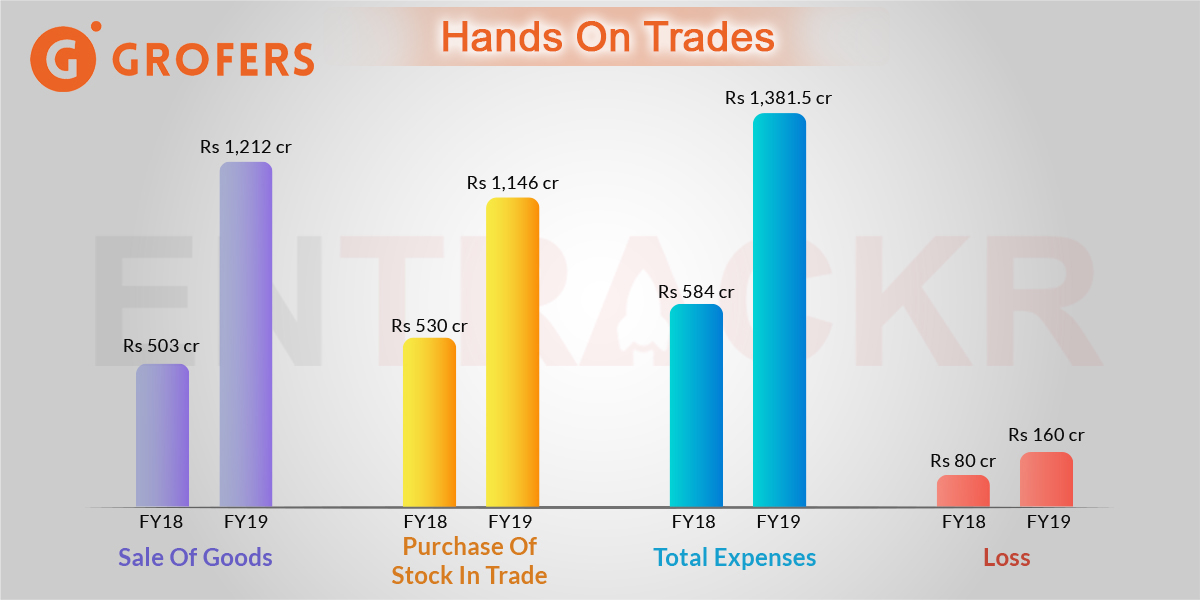

Starting out with Hands-On Trades, the company sold goods worth Rs 1,212.15 crore in the year ending in March 2019. During FY19, sales grew 2.4X from Rs 503 crore in the previous fiscal. It earned another 9.34 crore in finance income.

On the other hand, Grofers India that handles business support and administrative services for both retail and whole trade operations for Grofers brand in India earned Rs 70.15 crore in operating revenue. It registered 2.35X growth during FY19 as compared to Rs 29.83 crore earned in the preceding fiscal.

On top of the operating revenue, Grofers India also made Rs 13.5 crore through deposits and mutual funds in FY19.

Hands-On Trades Pvt Ltd in FY19

Purchase of stock in trade for Hands-On Trades grew 2.16X from Rs 530 crore in FY18 to Rs 1,146.11 crore in FY19 as the number of orders processed by the company surged. These purchases made up most of the expenses incurred by Hands-on Trade as almost all of the business support services were handled by Grofers India.

Hands-On Trades spent nearly Rs 19 crore on employee benefits in FY19. Expenditure on outsourced manpower grew by 84.4% to Rs 59 crore in FY19 from Rs 32 crore in FY18. Moreover, Rs 33.35 crore was spent on rent, out of which Rs 11.4 crore was paid to Grofers India.

While Grofers India handled most of the freight and packaging, Hands-On Trades also spent about Rs 11 crore on the same in FY19. In the end, the total expenses for the company grew 2.36X to Rs 1,381.5 crore in FY19 from Rs 584 crore in FY18.

The sharp rise in overall expense caused a two-fold increase in Hands-On Trades losses to Rs 160 crore in FY19 from about Rs 80 crore in FY18.

To fuel these expenses, Hands-On Trades raised around 212 crores through the issue of shares and also took a loan of Rs 153 crore from Grofers India and paid Rs 3.41 crore as interest on the same.

Grofers India Pvt Ltd in FY19

Grofers India Pvt limited’s total expenses soared to Rs 531.6 crore in Fy19 from Rs 311.8 crore in FY18, registering a 70.5% growth.

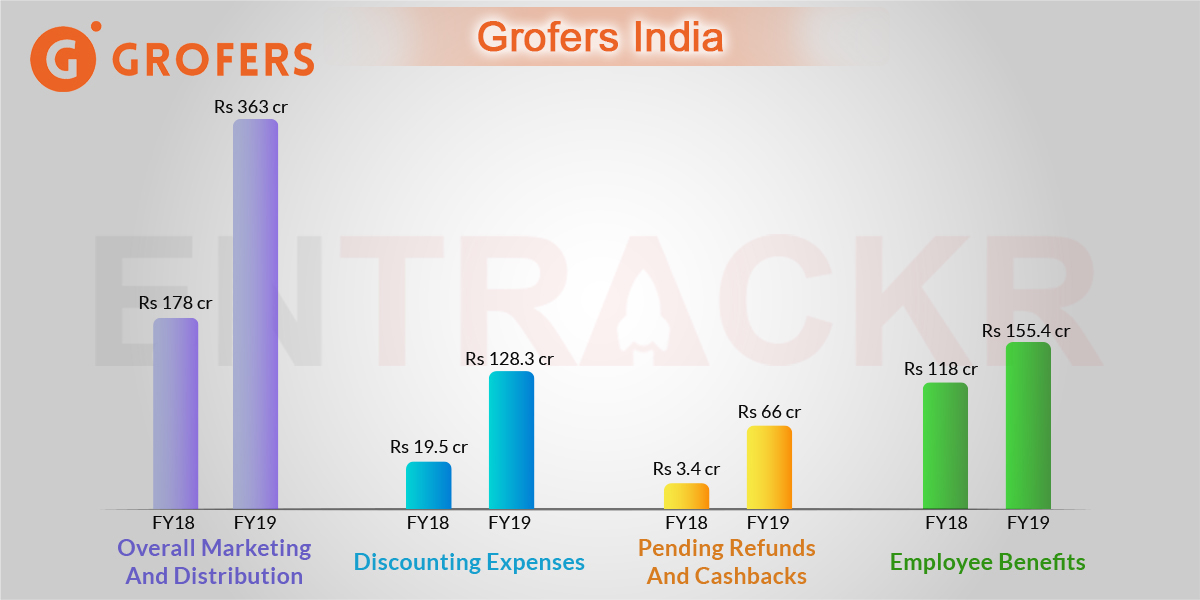

Employee benefit expenses also grew by 31.7% to Rs 155.4 crore in FY19 from Rs 118 crore in FY18 whereas expenses on IT resources also surged 2.12X to Rs14.5 crore in FY19 from Rs 6.8 crore in FY18.

Grofers India also handles freight and packaging for the group and spent Rs 65.6 crore on the same. While these expenses grew by 65%, legal expenses also shot up 2.06X to Rs 6.2 crore during FY19 from Rs 3 crore in FY18.

To push sales, Grofers India burnt Rs 128.3 crore on discounts in FY19, growing 6.6X in contrast to Rs 19.5 crore in FY18. At the end of FY19, Grofers India’s balance sheet had customer refund payable of Rs 66 crore, growing 19.4X from Rs 3.4 crore in FY18.

Business promotion expenses grew 54.3% from Rs 60.03 crore in FY18 to Rs 92.6 crore in FY19. This is also because the platform has positioned itself as a budget-friendly grocery and FMCG destination. The company also had ramped up its ‘Smart Bachat Club’ that lets members shop at prices as low as to wholesale prices.

Overall, 68.3% of total expenditure ~ Rs 363.2 crore ~ was spent on marketing and distribution, doubling from the expenditure of Rs 178 crore in FY18. This can be explained as in January Grofers launched a new sale which was heavily promoted. Overall, during FY19, Grofers India’s losses grew by 73.44% to Rs 448 crore in FY19 from Rs 258.3 crore in FY18.

Earlier this year, Grofers raised $220 million from SoftBank Vision Fund, Tiger Global and others. Founded in December 2013, Grofers has had gone through multiple pivots in its six years old journey. Since the beginning of 2018, it made probably the last pivot to focus largely on private label brands across grocery and FMCG categories.

Its focus on private labels has also increased this year tremendously, so much so that the company is in the process of becoming a new-age FMCG brand. As Entrackr reported three weeks ago, Grofers is housing its private-label products in local neighbourhood stores in a bid to increase sales in a sector with wafer-thin margins.