E-commerce giant Flipkart is a company that’s wired a bit differently. Unlike other e-comm players who didn’t want to get into logistics and supply chain, it built an in-house solution – eKart – to surmount the most challenging issues of e-commerce.

eKart has often been hailed as Flipkart’s secret sauce giving it an edge over other e-commerce marketplaces including Snapdeal and Amazon.

Conceptualised by founders Sachin and Binny Bansal and the core team, the logistics division was headed by Ankit Nagori (now one of the co-founders at Cure.Fit) till 2015-16. Mihir Dalal’s book, The Untold Story of Flipkart, had detailed anecdotes about how eKart proved to be a big driver of the company’s brand.

The attempt at building an in-house logistics service has been paying off for the company in many ways. eKart is the largest e-commerce focused logistics company in India.

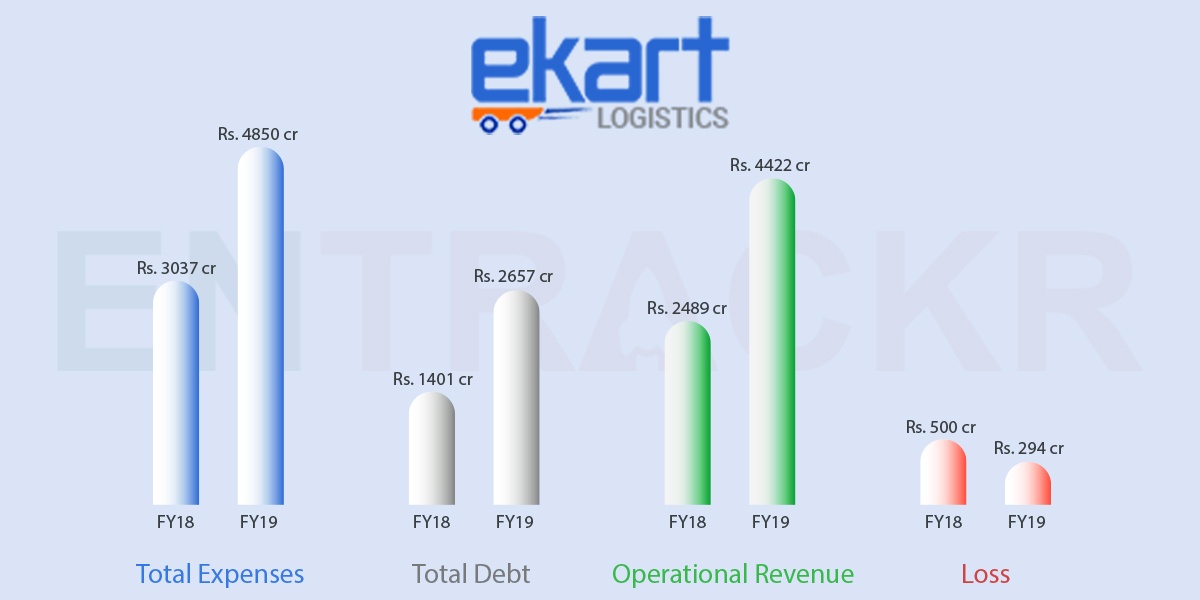

According to its holding entity Instakart’s annual financial statements, eKart has recorded a 78% hike in revenue to Rs 4,422.2 crore in FY 19 from Rs 2,488.7 crore in FY18.

About 88.8% of its operating revenues came from the delivery of goods for the marketplaces of Walmart-owned Flipkart group of companies in India. The rest 11.02% is earned from providing warehouse services to the group.

A significant jump – Rs 2,019.3 crore – in total income has helped eKart to offset losses which dropped by 41% to Rs 293.6 crore in FY19, from Rs 500.1 crore in FY18.

To drive growth and satisfy the demand of the growing number of orders, eKart has been spending significantly on its operational activities. Employee benefits expenses grew 45% to Rs 521.3 crore from Rs 359.5 crore. Interestingly, the company also outsourced contractual services worth Rs 1,128.6 crore in FY19 up 85% from Rs 611.3 crore in FY18.

Further, Rs 1,960 crore was spent on freight and forwarding charges, up 56% from Rs 1,257.3 crores in FY18. The increased spending pushed total expenses up by 60% to Rs 4,850 in FY19 from Rs 3,037 crore.

The financial statements emphasise that Flipkart has been investing heavily in Instakart to strengthen its supply channel. eKart has been acquiring fixed assets at an increasing rate. Its fixed assets portfolio has shot up 3.6X times from Rs 314.5 crore in FY18 to Rs 1,072.8 crore in FY19.

Further, driven by the 3.4X jump in short term loans and advances, the company’s current financial assets also grew to Rs 2,173.5 crore in FY19. With significant investments during the last fiscal, the total assets of the company rose 43% from Rs 2,452 crore in FY18 to Rs 3506.2 crore in FY19.

Importantly, the company shifted to a more leveraged position during the last fiscal as the total debt increased by almost 90% from Rs 1,401.4 crore in FY18 to Rs 2,657.1 crore in FY19. The capital gearing ratio also increased from 61.7% to 82.2% during the same period.

eKart has added current liabilities worth Rs 1,064 crore to its balance sheet in FY19, helping it achieve a positive net operating cash flow of Rs 956.1 crore in the last fiscal, in contrast to operating cash outflows of Rs 545.3 crore in FY18.

If we look at overall e-commerce focused logistics companies in India during FY19, eKart was the largest supply chain and logistics company. SoftBank-backed Delhivery had a revenue of Rs 1,695 crore with a net loss of Rs 1,781 crore. On the other hand, Ecom Express posted a revenue of Rs 1,006 crore while its losses stood at Rs 130 crore.

Hence, the numbers say that eKart was the largest e-commerce focused logistics firm in India in FY19.