Digital payments and lending firm True Balance has raised $23 million in a Series C funding round from Korean investors including NH Investment & Securities, IMM Investment, D3 Jubilee Partners, SB Partners, HB Investment, and existing investor Shinhan Capital.

The SoftBank-backed company will deploy the fresh proceeds to expand its loan book, strengthen its technology, and bolster its business-focused talent acquisition efforts.

Previously, it had raked $23 million in a bridge round in April 2018 followed by several small tranches from parent entity – Balancehero.

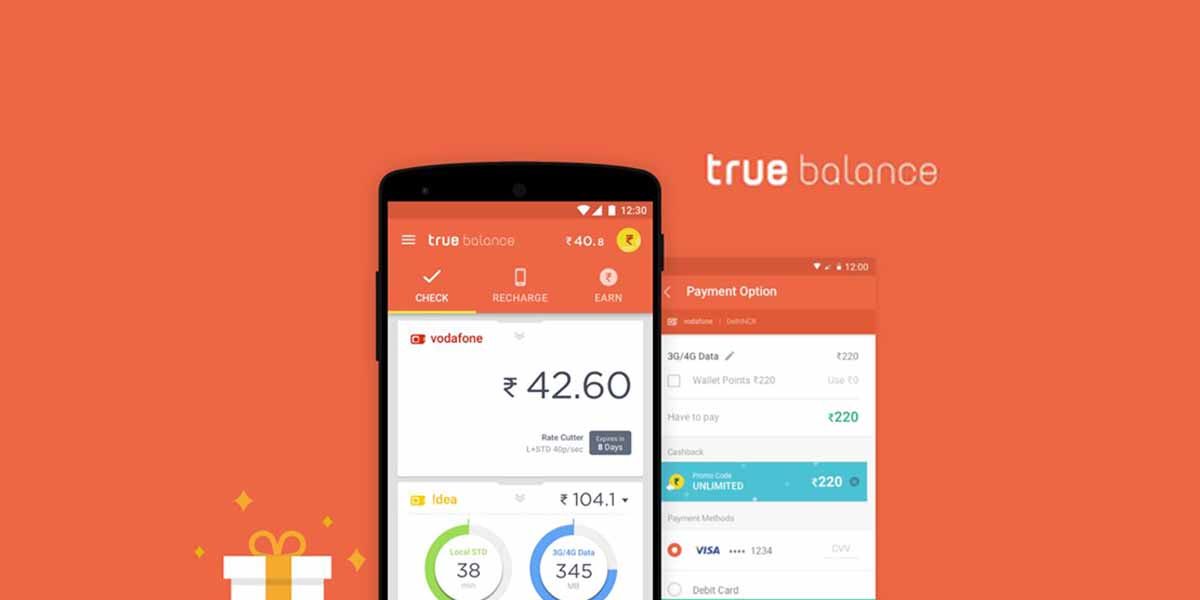

True Balance allows users to check their mobile call and data balances, without the need for internet connectivity. It facilitates consumers with real-time information on the best plans and offers from telecom operators and helps them recharge their prepaid mobile accounts.

Unlike other recharge options, such as Paytm, Freecharge, and MobiKwik, True Balance focuses primarily on mobile balance management.

Two years back, True Balance had received an RBI license to operate its wallet service in India and began its operation on December 2017. True Balance wallet lets users pay in advance for mobile recharges, much like Paytm and Mobikwik, and users can also send money to each other using UPI.

Recently, it has partnered with a Mumbai based NBFC HappyLoans to provide the financial services and had received undisclosed funding from ICICI Bank Ltd. for its growth plans.

True Balance’s FY 19 report reflected that the company’s revenue increased by 49.8% from Rs 5.97 crore in FY18 to Rs 8.95 crore in FY19 while the loss was stood at Rs 46 crore.

As of now, the firm claims to clock 3,00,000 digital transactions per day with a total of 70 million app downloads. It’s aiming to reach 100 million digital touchpoints and become a leading fin-tech company in India in the next three years.