Digital payment in India is witnessing increasing adoption from consumers and businesses. And the advent of UPI and new digital payment modes have accelerated the process.

In the last fiscal ending March, the digital transaction has seen growth over 380%, according to ‘The Era of Rising Fintech’ by Razorpay report. The third edition of the report analysed the patterns of digital transactions among consumers and the impact of industry innovations like UPI.

The digital payment saw over 100% demand from customers in the last nine months, whereas in the same period, UPI witnessed 222% growth, it added. Bengaluru is still the top city in the country in digital payment adoption, followed by Hyderabad, Delhi, Mumbai, and Pune.

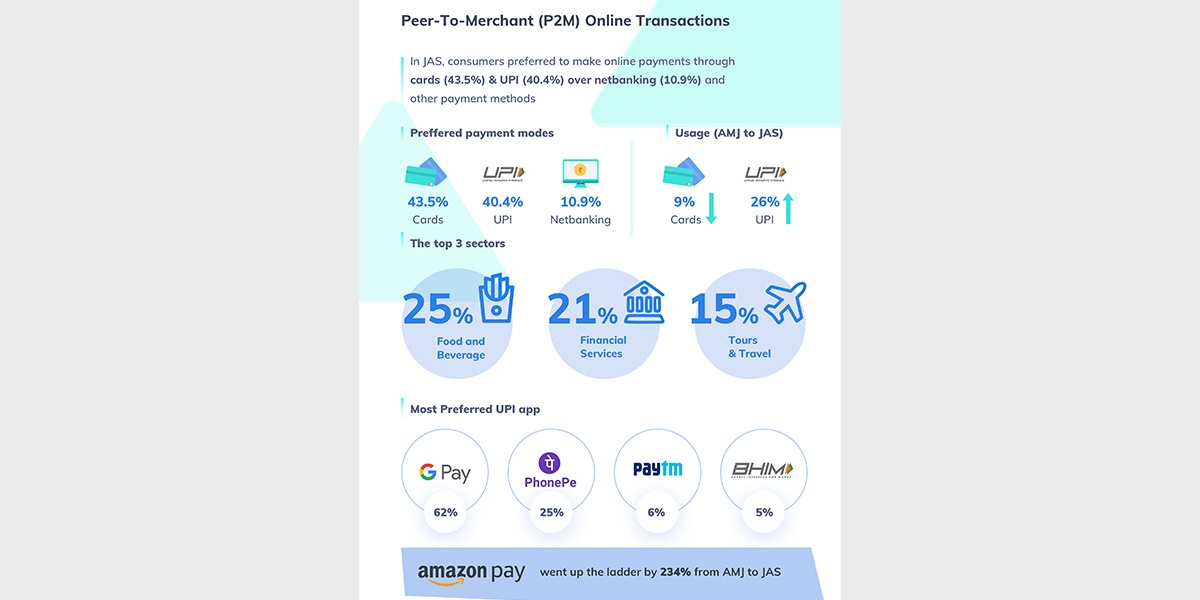

In peer-to merchant (P2M) transactions, the most number of consumers still prefer doing transactions through cards. Close to 43% of consumers preferred making online payments with cards whereas around 40% via UPI. Net banking was the least preferred mode with 10.9%, outlined the report.

Though, in the last six months, UPI payment mode saw usage surge in adoption to 26%. In India, Google Pay is the most preferred UPI app with a contribution of 62% in the last three months, followed by PhonePe with 25%, Paytm with 6% and Bhim with 5%.

Among the sectors, the highest adoption of digital payments was seen in the Food and Beverage sector (25%), followed by Financial Services (21%) and Tours and Travel (15%).

The report further expects that digital payment will be driven by tier 2 cities and add 15% to India’s GDP by the end of next year.

The acceptance of recurring payments and more SME-oriented products and services have proven to be beneficial for digital businesses this year, said Shashank Kumar, CTO and Co-Founder, Razorpay.

The incentive-based payment programs, new age banking, and collaboration between banks and FinTech firms will be beneficial for the digital payments ecosystem, added the report.

At present, Razorpay claims to power digital payments for more than 6 lakh businesses including IRCTC, Airtel, BookMyShow, Zomato, Swiggy, Yatra and Zerodha, among others and plans to increase this to 1,000,000 by 2020.