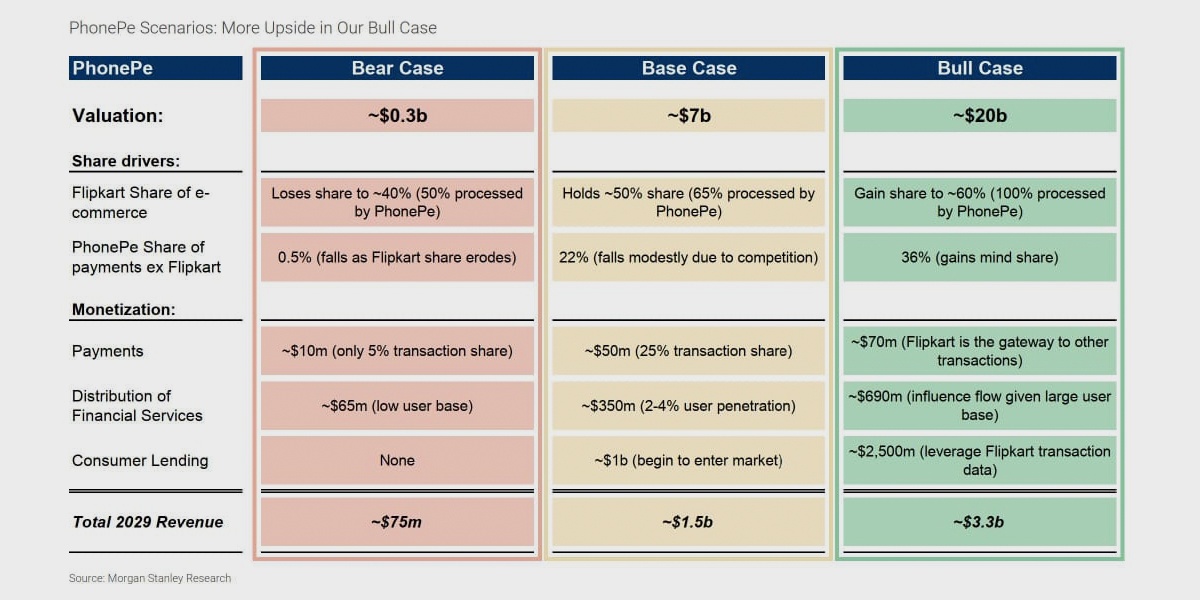

PhonePe may get the tag of the second most valued company in digital payment space after Paytm. According to American multinational investment bank and financial services company, Morgan Stanley, the Flipkart-owned company is being valued at about $7 billion.

This is the first-ever official statement coming from any financial institution over the valuation of PhonePe.

According to Stanley, PhonePe could be worth as much as $20 billion in the bull case. Interestingly, PhonePe can be as big as Axis Bank and will be only behind some of the top banks in the country such as SBI, Kotak, HDFC and ICICI in terms of valuation.

The forecast by Stanley will also have a massive impact on Flipkart’s owner, Walmart. The Bentonville-based company’s share price has hit $118, an all-time high, and it could go up to $125 in the base case and $165 in the bull case.

Further, the report has framed three different scenarios for PhonePe for next 10 years. The data outlines that PhonePe could generate revenues of $70 million from payments vertical in bull case, $690 million from the distribution of financial services, and $2.5 billion from consumer lending by 2029.

It’s worth noting that PhonePe is yet to make debut in lending.

The report comes on the heels of PhonePe’s multiple reports on fundraising that is expected to be around $1 billion at $10 billion valuation. Raising such a staggering round from the likes of Tiger Global, Tencent and DST Global may go through soon, but the valuation could be a hurdle.

According to Entrackr sources, its fundraising talks with Tencent has been stuck over valuation. PhonePe was valued at about $1.5 billion after Walmart-Flipkart deal.

For the financial year ending on March 31, 2018, PhonePe recorded revenue of Rs 42.79 crore and incurred Rs 791.03 crore in net losses, way higher than Rs 129.01 crore in FY17.

As far as PhonePe’s revenue in coming years is concerned, the company’s future appears bright in a long haul following its foray into financial and wealth management services. Besides, PhonePe has now become the largest contributor to UPI volume, outrunning closest rival Google Pay and Paytm.

The report also predicts that UPI transactions could be $2.5 trillion by 2029 growing at a 35% and PhonePe will have 25% market share after 10 years.

Apart from P2P transactions, PhonePe is also leading in terms of merchant payments.

The development was reported by TOI.