Not only is the OYO seeing changes in the management structure, organisation structure, and business offerings, but also the equity shareholding pattern.

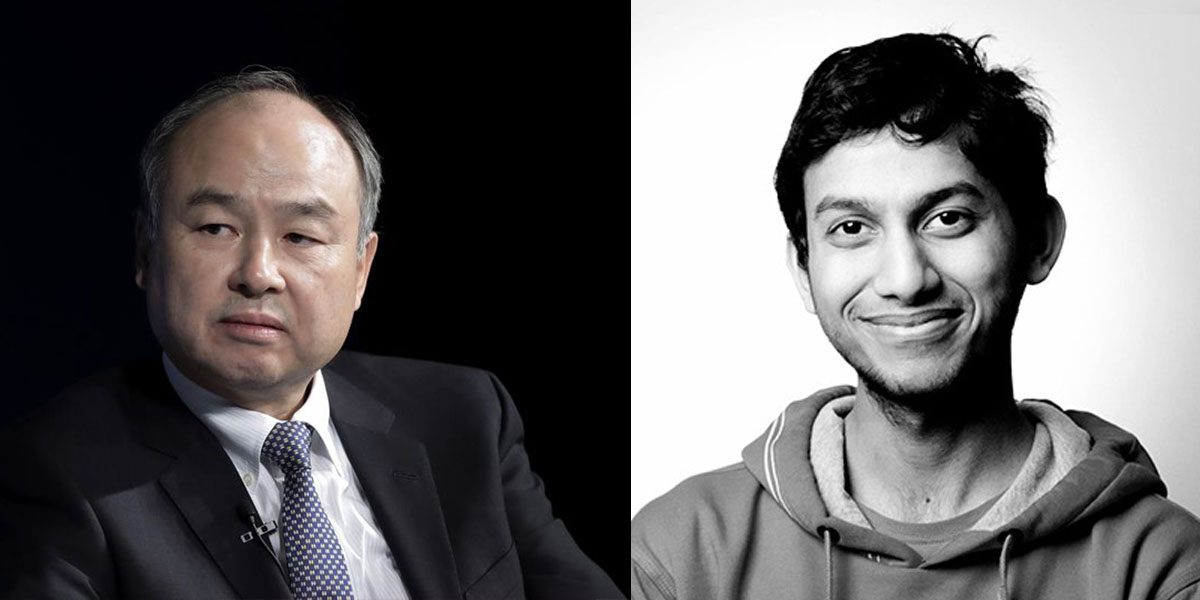

Several reports have been circulating in the media in recent times illustrating how OYO is looking to raise $1.5 billion at a valuation of $10 billion. And other media reports are sure that Ritesh Agarwal is himself securing the amount via debt.

Or maybe, RA Hospitality Holdings (Cayman) is going to raise that debt.

This Cayman-based company has filed a Proposed Combination with the Competition Commission of India, where it seeks to acquire equity securities in Oravel Stays Private Limited. The document requests CCI to allow both – the purchase of new shares as well as “the acquisition of part of the equity securities held by certain existing shareholders of OYO.”

Later in the filing, the parties clarify how RA Hospitality Holdings, where RA most likely stands for Ritesh Agarwal, has no operations in India and this proposed combination is in no way going to change the level of competition in the Indian hotel and hospitality services market.

The media reports had claimed that Agarwal was in talks to raise the $1.5 billion in debt to buy back the shares of early investors like Lightspeed and Sequoia and increase his shareholding in the company to over 29% from the current 9%.

This document validates this plan whereby, RA Hospitality can either secure the debt directly from the banks (or bank – singular) or Agarwal could pour the personal debt in this entity to secure shares from Sequoia, Lightspeed and other to increase his ownership to 1/3rd.

And if we go by The Ken report on OYO published recently, this debt is going to be secured from Japan-based Nomura Bank with a push from SoftBank which cannot increase its stake in the India based hospitality chain beyond the 50% cap.

Here, the step to open a mediating entity in Cayman that will help Agarwal as well as SoftBank to execute their separate and joint plans without facing legal obstacles makes complete sense.

(hat tip: paper.vc)