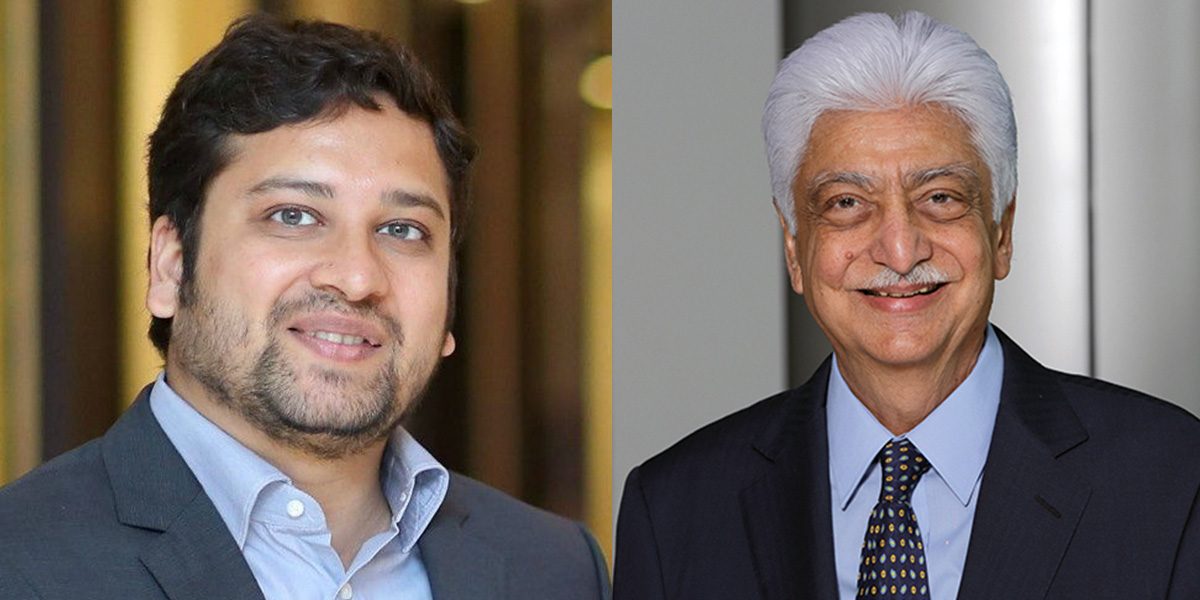

Venture debt fund Alteria Capital has closed its maiden fund at Rs 960 crore, with Binny Bansal, Azim Premji Foundation and Kiran Reddy leading the final tranche.

Touted as the biggest venture debt fund in India, Alteria Capital India Fund I got the RBI nod to raise funds in 2017. After raising Rs 356 crore in its first-round from institutional investors like IndusInd Bank, it has also received capital commitments to the tune of Rs 157.5 crore from SIDBI, which is acting as an investment vehicle for the central government under its fund of funds program.

As per a statement released by the Mumbai based firm, the fund has been oversubscribed at Rs 960 crore with the greenshoe option against the initial corpus of Rs 800 crores. The final close comes after the fund announced its second close at Rs 625 crore in Q3 last year.

Alteria Capital’s average cheque size ranges from Rs 15-20 crores focusing on initial and growth-stage companies in the startup ecosystem. It has pledged around Rs 615 crore among its varied portfolio of startup investments.

It has extended debt financing option to a number of companies with the likes of Lendingkart, delivery app Dunzo, real estate startup Stanza Living, Raw Pressery and even the Virat Kohli backed apparel brand Wrogn in its loan book.

The brainchild of Ajay Hattangdi and Vinod Murali, former senior executives at Temasek-backed InnoVen, Alteria Capital had also launched Activate, a startup accelerating platform last year.

As per Murali, Alteria plans to use Activate as a hook for initial stage startups who’re looking for organizational support.

“Alteria Activate is to try and make multiple notes fire not just within the entrepreneurship ecosystem but also corporate India. It will create room for engagement, investments, market access, revenues, acquisitions, etc.,” he said in a statement.

Activate helps early-stage ventures to connect with large listed corporates and other late-stage startups. It provides a whole bunch of services apart from credit and for a membership fee, it is available to banks, domestic family offices, and corporates in India.

The development was reported by TOI.