Fintech is hot in India and investors are continuously chasing deals as they don’t want to miss on the opportunity of making a killing out of the fledgling segment. While Paytm and PhonePe have been negotiating fresh rounds with Alibaba and Tencent-Tiger Global respectively, QR code-based payment app BharatPe is raising at least $75 million in a fresh round.

According to two Entrackr’s sources, the firm has finalized $75 million round led by Insight Partners. “Existing investors along with a couple of US-based hedge funds are also participating in the Series B round,” said aforementioned sources.

Sources requested anonymity as they aren’t authorized to speak to the media.

The Series B round is coming just after three months of raising $15.5 million from Sequoia Capital, Beenext and Insight Partners. “Insight had invested only $5 million in the Series A round. However, in this round, the global venture capital firm is pouring in $35-38 million. Sequoia is participating in the round on a pro-rata basis,” added sources.

Importantly, BharatPe is trying to take the round up to $100 million. “It’s in advanced talk to raise additional $25 million but nothing has materialized beyond $75 million at the moment,” emphasized sources.

It’s worth noting that BharatPe was valued anywhere between $60 to $65 million in Series A round. But its valuation is set to soar 5 to 6X. “The firm is valued about $330 to 350 million in the fresh Series B round,” mentioned sources.

This is eye-popping valuation in a very short duration – only three months.

Besides backing from institutional investors, BharatPe also raised capital from bluechip angels including American Express’ top executive Sanjay Rishi, PayU co-founder Nitin Gupta, PineLabs CTO Nipun Mehra, ex Paytm and Tokopedia VP Amit Lakhotia, and Hero group Akshay Munjal.

“The deal is likely to be announced in the next couple of weeks,” outlined one of the aforementioned sources. Queries sent to Insight Partners and Sequoia Capital did not elicit an immediate response while BharatPe declined to comment on the matter.

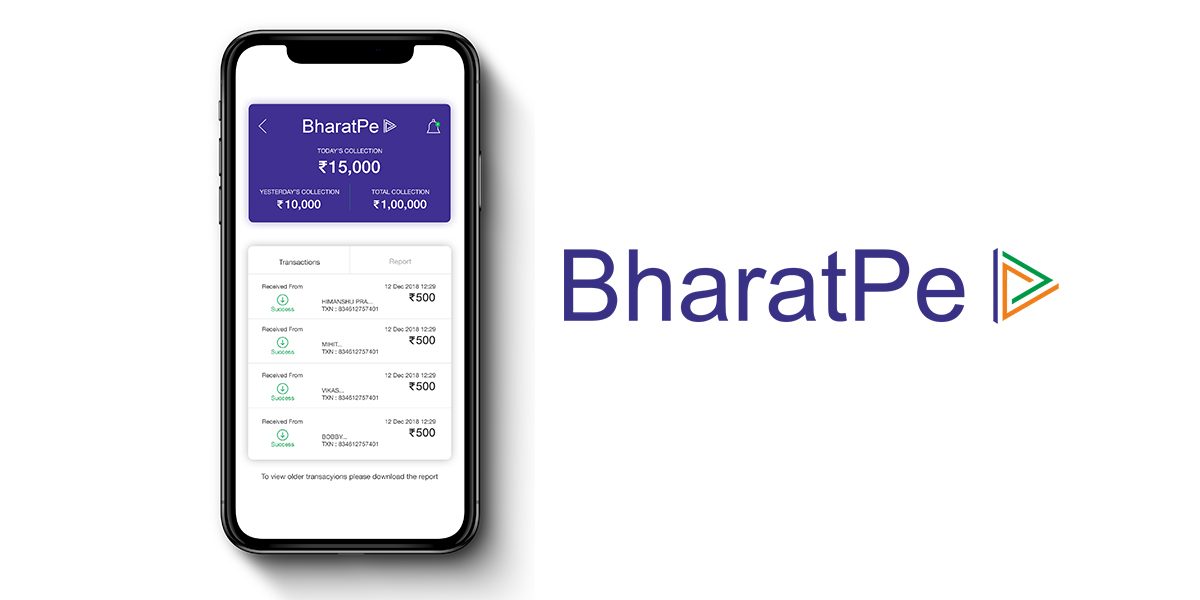

Last we heard, the company claimed to have about 9 lakh offline merchants who drive over 350K transactions on a daily basis via its platform. Apart from powering payments via interoperable UPI QR codes, it recently began disbursing loans to the merchant based on transaction histories.

BharatPe has partnered Apollo Finvest to offer loans with ticket sizes between the range of Rs 10,000 to Rs 1 lakh at a lucrative interest rate of 1.67%.

BharatPe has emerged as a strong player in the UPI segment in the past couple of years. The UPI ecosystem is largely being fought by deep-pocketed players such as Paytm, PhonePe and Google Pay. By focusing on QR code payments meant to be used across offline merchants, the firm has scaled up really fast.