Update: The story has been updated with responses from Gururaj regarding several aspects. Read these responses in italics format.

Qikpod. Ring a bell? No? We don’t blame you.

This was a company that created a minor disrupt with its idea a few years ago. I’m sure we’ve all had the problem of figuring where to get our orders delivered and making sure we’re actually there at that time. Sometimes, even when are there, the stars align to make sure we miss that one awaited call.

Qikpod had entered the market to get rid of all those problems. Ravi Gururaj, a serial entrepreneur had promised to bring a disrupt in the e-commerce and logistics market with delivery collection solutions (aka smart locker).

He started a company that would offer smart lockers in metro cities where the delivery boy would keep the consignment, and the customer would be able to pick it up from there at his or her own convenience.

This was a B2B play where Qikpod would partner with third-party logistics and e-commerce players to offer the locker services. The process, as per Gururaj, involves “site acquisition, hardware manufacturing, deep software integrations into 3PL backends, network monitoring and upkeep, patient consumer education, etc.”

Great idea, right? Everybody thought so. In one of the rare incidents at that time (2016) in Indian startup ecosystem history, Qikpod received a seed round as big as $9 million from a slew of blue-chip investors.

It was both because of the man behind the idea Gururaj and his rise to fame with serial entrepreneurship and investment-related activities, and the idea itself. The company saw institutional names such as Accel Ventures India, Delhivery, Flipkart, Foxconn, Central Park, and Ariston Capital investing in it.

Blue chip HNIs – Mohandas Pai, Ratan Tata, Soudamini Abhishek Goyal , Arun Seth (Chairman, NASSCOM Foundation), Raman Roy (ex Chairman at NASSCOM and current at Quatrro ), Rajan Anandan, Keshav Murugesh (WNS), Ganesh Natarajan (5F World), Sumit Jain, Raghunandan Gangappa, Ganesh Krishnan, Pranay Chulet, Kunal Shah, and Errol John Peter Fernandes – also invested in the firm.

The VCs together poured in Rs 56.81 crore and the HNIs poured in Rs 2.15 crore altogether, taking the grand total of investment in the firm till date to Rs 58.96 crore.

But…

What happened to all this money?

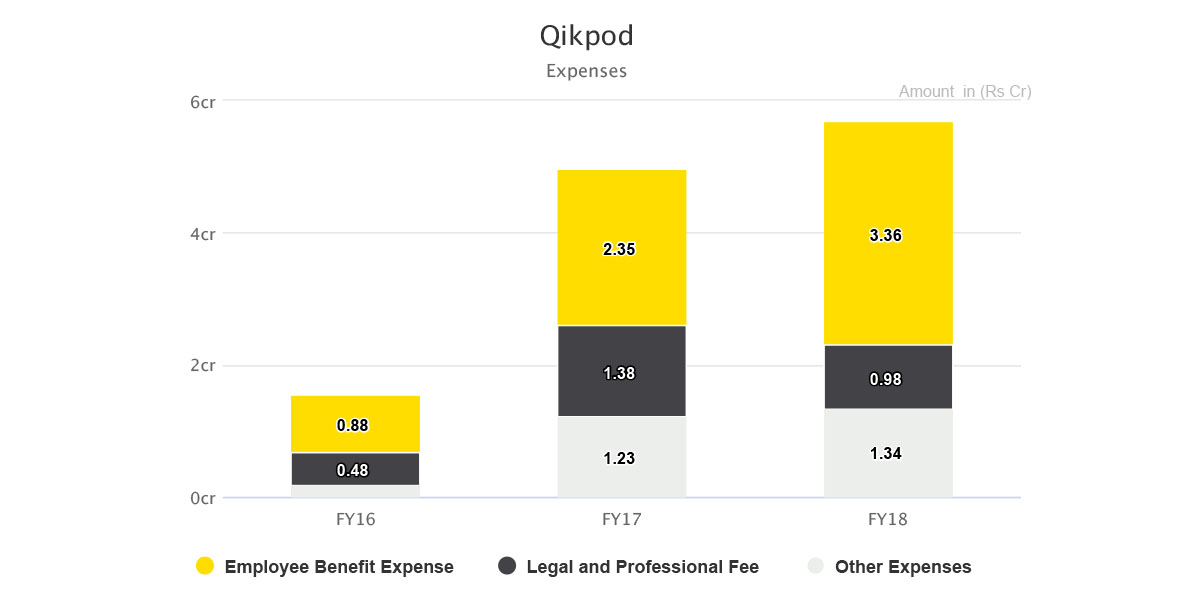

Well, most of the raised amount still remains unused. In the three reported fiscal years from FY16-FY18 the company has spent a total of Rs 12.19 crore, starting with Rs 1.55 crore in FY16 and capping at Rs 5.68 crore in FY18 with a 91.4 per cent year-on-year (YoY) increase rate.

As we can see in the Expense graph below, the majority of this money was spent on employees, and the next largest portion was accounted for by legal and professional fee.

This fee takes us back to May 2016, the second month of FY17 where Gururaj was slammed with a suit by one of company’s potential top executive, Neeraj Ray over equity issues.

Ray accused Gururaj of not issuing him the shares he was promised under an equity product and demanded the product Meralocker to not be launched till the case was pending as he himself had contributed to the product innovation. (Read Inc42 for the whole story)

Later, Karnataka High Court had ruled in favour of the company, completely vindicating it.

The ‘Qikpod’ product was still launched in Bengaluru and the aim was to create the world’s largest smart-locker network with 50,000 lockers across all the major metros.

When asked about this expense pattern, Gururaj explained that most of the investment is made in R&D (engineering payroll) and sales and business development to build out the locker deployment.

“We have been extremely judicious and frugal with our investor funds and even today after much R&D investments, investment in hundreds of lockers across 7 cities, etc, we still have ~90% of the original investor funds still available to us to execute on our plans and will not have to raise more capital near term,” says Gururaj.

According to him, there are 650 plus locker units in Bengaluru, Hyderabad, Mumbai, Kolkata, Pune, and Chennai and new units are claimed to be added to this network every week. The aim now, is to expand to 5 more cities prior to Diwali sales season.

While all of this makes sense, one question that keeps one scratching head is that even if the company is a B2B play how does the expense column not reflect any expense in hardware manufacturing or software integration. Rent, repairs, locker testing, and freight together cost Rs 68.78 lakhs in FY18 and Rs 72.22 lakhs in FY17.

This collective cost is in fact much lesser than the legal and professional fee in both years. Further, the infra and logistics investment has taken a downturn in the last reported fiscal.

If the properties are increasing day by day, why did the rent decrease in FY18?

As per Gururaj, both the downturn in infra and logistics investment and decrease in rent expense is due to the company’s ability to optimize the costs, becoming more efficient, reducing warehousing expense, and paying only nominal rent and electricity charges.

As far as legal and professional fee was concerned, he claims that the “item covers accounting, contractors as well as other compliance related expenses in addition to any legal.” He also clarified that “QikPod had near to zero legal expense over the most recent 12 months.”

Further, he claims that the capital manufactured is captured in the Tangible Asset entry of the Balance Sheet which, as Entrackr verified, grew from being worth Rs 12.33 lakhs in FY16 to Rs 1.7 crore in FY17 to Rs 1.81 crore in FY18.

Not only the investment in categories that result in direct growth of the business – the core business – is lousy, the revenue follows the same pattern.

What type of revenue was earned?

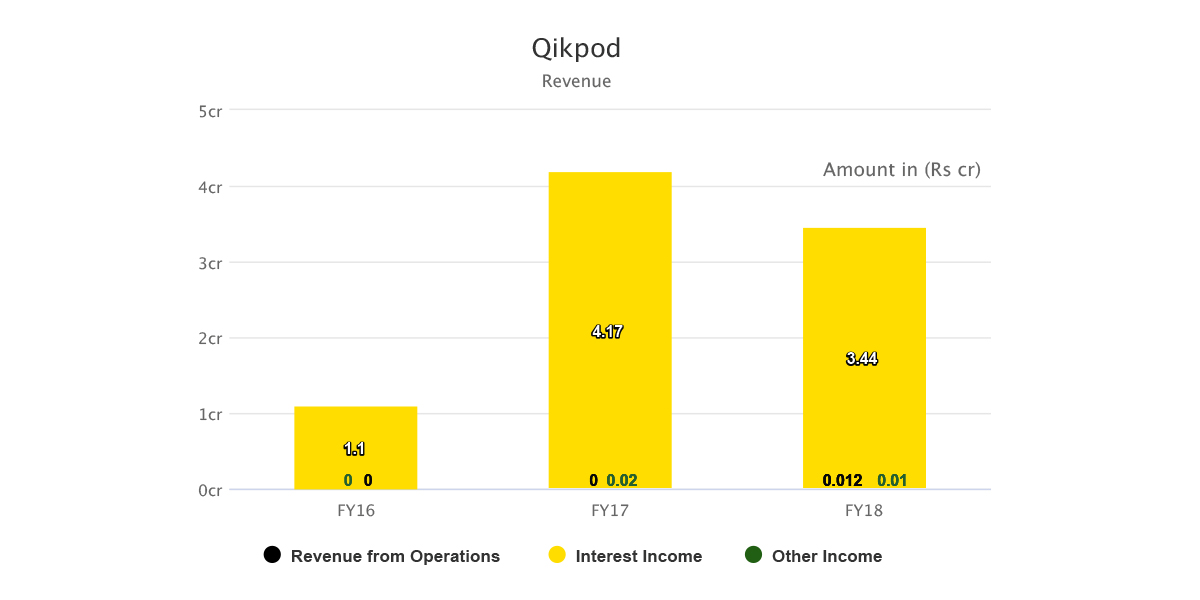

If Qikpod spent Rs 12.91 crore in 3 fiscal years, it earned Rs 8.72 crore during the term. The first fiscal (FY16) saw the bank balance increase by Rs 1.1 crore and with a 77.1 per cent YoY in FY18 the increase was worth Rs 3.45 crore. However, in FY17 the revenue peaked at Rs 4.17 crore, showing a 17.3 per cent decrease in FY18.

But that’s not it, most of these figures, as visible in the graph (yellow portion), are a literal increase in bank balance – interest income.

Revenue from core operations was only earned in FY18 – a minimum of Rs 1.26 lakhs.

However, this is all not without explanation. Qikpod hasn’t started pure play monetisation yet. Gururaj, explains that to establish a B2B logistics locker business, which is entirely new to India, a gestation period of 7-10 years is required. The company is only halfway through the process.

As far as revenue was concerned, Qikpod doesn’t charge consumers any fee, neither does it charge the e-commerce players as of now. First, he wants to achieve a scale in terms of optimum traffic and utilisation, after which he will charge the 3PL and eCommerce partners with an operational fee.

In a detailed response, Gururaj explained that the company “does bill 3PL partnersfor their usage of lockers.”

Sounds reasonable enough, until we look at another such player operating in another region.

The Smartbox of Delhi NCR

There is another entrepreneur who believed in the same segment and started in Delhi NCR in April 2015. Amit Sawhney, Founder, and CEO of Smartbox started the company in 2015 with no investment from Angels or institutions. It is a company that counts big names like Mi, Flipkart, Oriflame, DLF, Cognizant etc. as its partners.

With Rs 1 lakh in share capital, Amit and Vineet Sawhney bootstrapped the firm and during FY17 and FY18, the company has earned a total of Rs 67.34 lakhs. Out of this, Rs 67.27 was straight from the core operations of the firm.

However, over 60 per cent of this revenue (Rs 43.68 lakhs) is a part of trade receivables.

Even if we differentiate the two companies on the basis of their monetization practices and operational regions, there still remains the question of which way is the better to go. Not to forget that Qikpod banks on investor money, showed a minor dip in the FY18 performance as compared to FY17, and can’t seem to grow over its legal and professional expenses.

Gururaj seems to be justified when he asserts that building a smart locker is a long term haul and requires raising infrastructure from scratch. But Qikpod has spent over three years in the business and is still unable to find any ground, forget firm ground. Despite all arguments from Gururaj, it is obvious that the company is yet to take off.

Since Gururaj kept emphasising that he has a plan, conviction, and capital to build Qikpod while answering our queries, Entrackr will keep a hawk eye on how he pulls off from here.