After leading financial technology funding for the last four quarters in Asia, China’s gigantic fintech industry has for the first time witnessed a downfall in the first quarter of 2019.

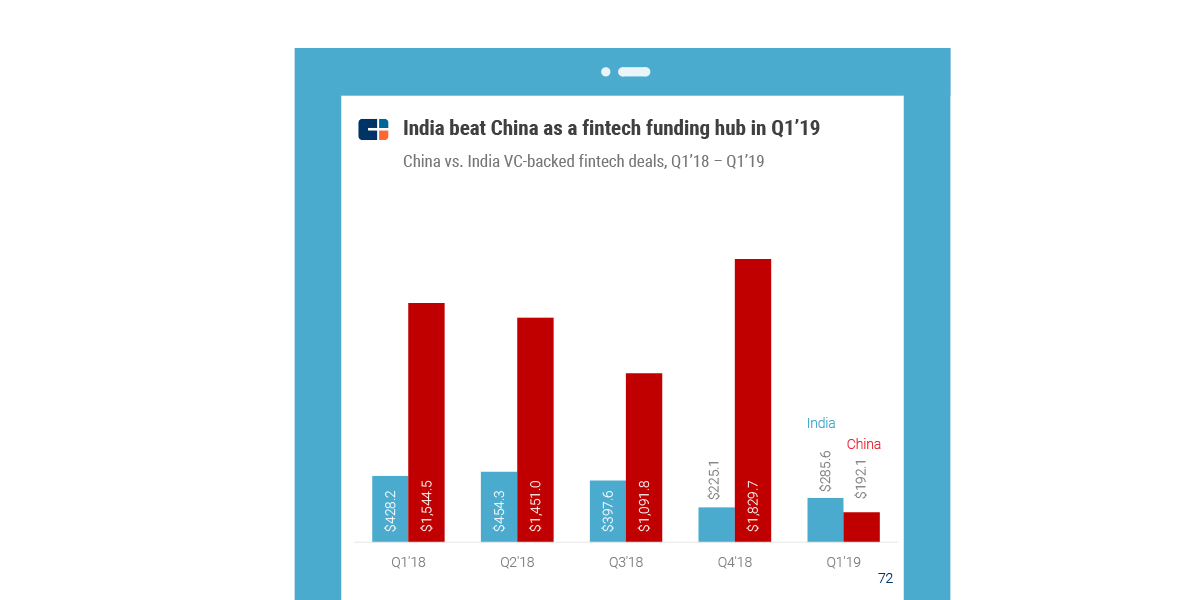

China only saw $192 million worth fintech funding in the first quarter, which is about 89% less than last quarter while India witnessed 27% more funding in the quarter to $286 million, according to a new report from data provider CB Insights.

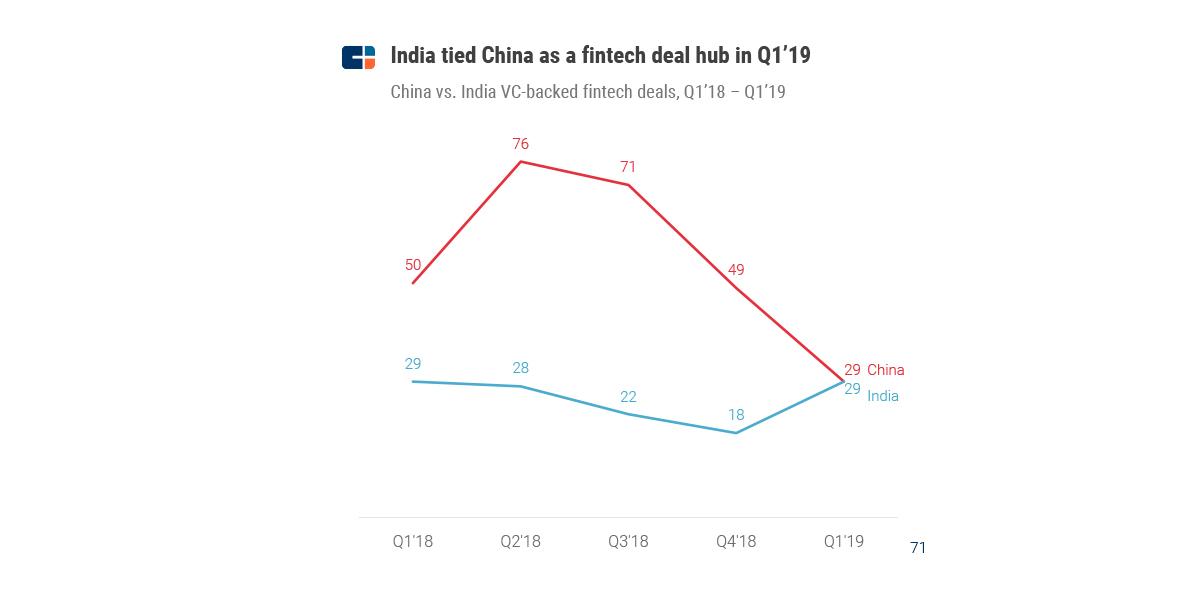

In terms of deals, both countries saw 29 deals. This is a huge plummet for China, which had seen about 49 deals in last quarter whereas India stood with merely 18 deals in the same period.

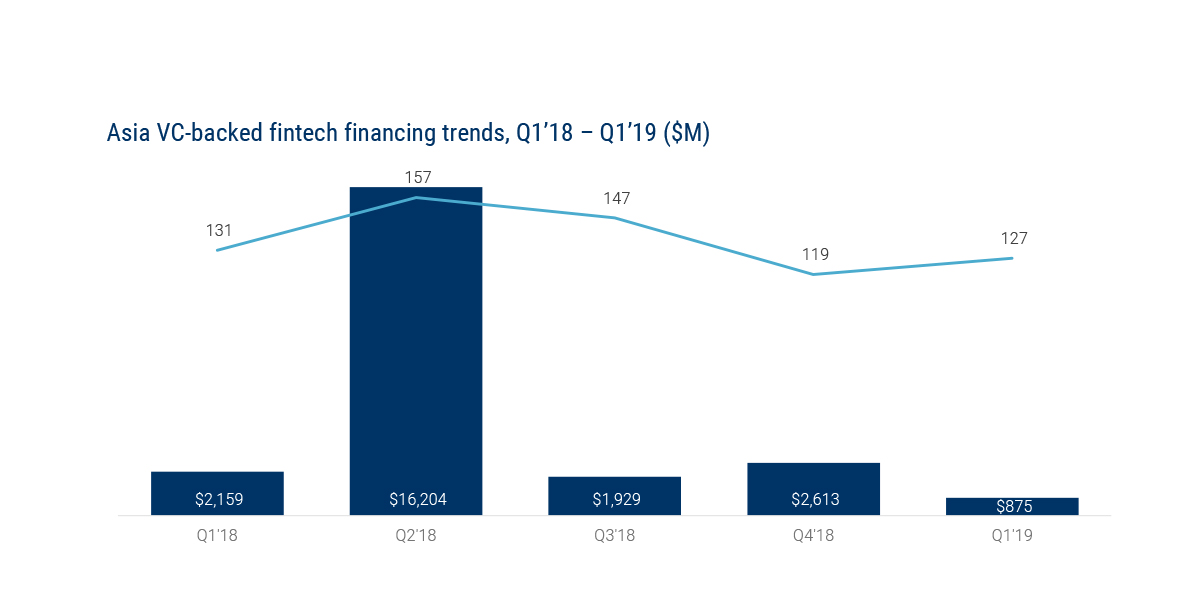

In total, Asia saw about $875 million funding, the first time below $1 billion in the last five quarters, in financial technology domain across 127 deals. In compare to the first quarter of last year, funding in fintech startups has gone down to about 87 %.

The downfall in China fintech industry is largely due to recent tight regulations by its government, added CB Insights. The Chinese govt has been cracking down on fledgling online lending industry following reports of defaults, sudden closures, and frozen funds.

Last year, over four thousand P2P lending platforms failed (under investigation by police or unable to repay investors) after the Chinese regulator crackdown, according to Yingoan Group.

The Chinese regulator also found some of these platforms being involved in raising funds illegally and running Ponzi schemes busted after the crackdown.

Whereas, India market, which is home of about 500 million internet users and 150 medium-sized enterprises, is still very nascent and drawing investors. Meanwhile, P2P firms in the country are still grappling with a high default rate and disbursement limitation for lenders.

The segment offers a huge opportunity for existing and new players. Recently, Amazon has started offering P2P payments.