Google Pay seems to have emerged as the most popular digital payments platform in India. Along with witnessing a constant rise in its user base, Google Pay has also become merchant favourite across platforms.

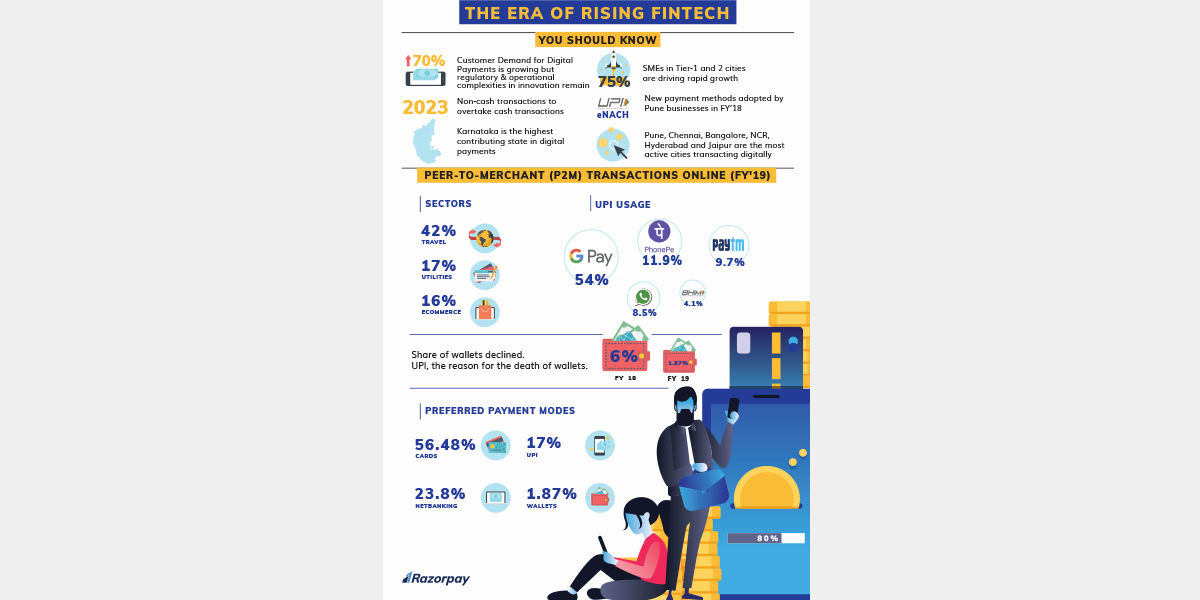

On converged payments solution firm Razorpay, Google Pay accounted for 54 per cent of merchant transactions, which is 8 percent lesser than last year figure. Razorpay in its report ‘Era of Rising Fintech‘ accessed by Entrackr said Paytm and PhonePe were way behind with 9.7 per cent and 11.9 per cent respectively merchant transactions on the platform. BHIM merely managed 4 per cent of those transactions.

In the past six months, Google UPI app has grabbed more market share than any of its competitors in the country. In this period, it saw its monthly active users reaching 45 million alongside Paytm and PhonePe.

In February, PhonePe and Google Pay were reportedly doing around 220 million transactions each while Paytm was leading the pack with 225 million transactions.

Last month, UPI recorded around 800 million transactions worth Rs 1,33,460.72 crore. Out of this, Google Pay recorded UPI transactions worth Rs 43,000-Rs 45,000 crore in March.

Whereas its rivals PhonePe and Paytm did 10K-15K crore less transaction in compare to Google pay.

Annually, Google claimed to hit $81 billion (or Rs 5.7 lakh crore) transaction run-rate in March. The tech behemoth is reportedly spending over $10-$15 million every month to draw more users on its platform.

Last month, Google Pay also partnered with Pine Labs to accelerate its offline transactions. The collaboration will give Google Pay access to over 3,30,000 point-of-sale terminals in over 3000 towns in India.

Meanwhile, the report hailed cards payment as a most preferred mode of transactions with 57 per cent of digital transactions. UPI accounted for 17 per cent while mobile wallets were at less than 2 per cent.

Among the multiple sectors where Razorpay is used, 42 per cent alone belonged to travel. Within four years of its operations, Razorpay claimed to have hit a run rate of $5 billion worth of transactions.

The report further outlined merchant demand for digital payments has seen a 70 per cent Year-on-Year (YoY) growth. Non-cash transactions are likely to overtake cash transactions in the country by 2023, it added.