Tencent-owned WeChat has been extremely successful beyond its DNA (instant messaging). Its inbuilt payments platform – WeChat Pay along with a mini programme have built the ‘WeChat Ecosystem’ that has over one billion daily active users (DAUs).

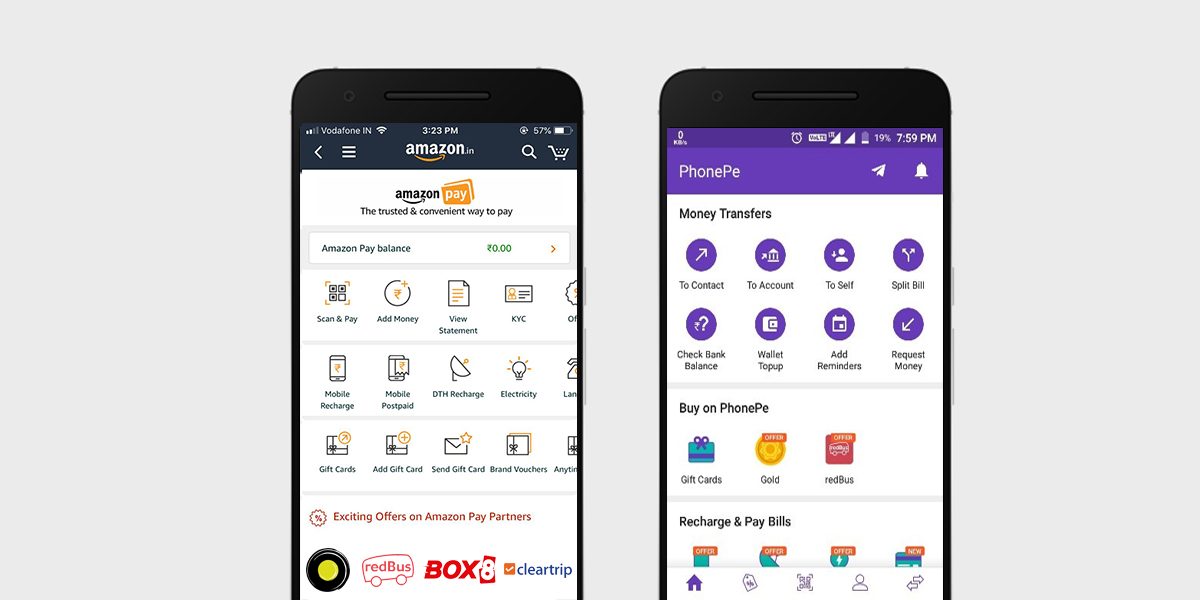

Because of its incredible success in China, several companies in India have been trying to foster WeChat kind of ecosystem. While Flipkart-owned PhonePe has been working on the super app for about a year, now Amazon India also has reflected an ambition to become aggregators of apps (aka a super app).

Citing anonymous sources, ET reports that Amazon is set to test air ticketing feature with Cleartrip. Amazon would leverage Tapzo that it had acqui-hired last year as well as Amazon Pay for its super app strategy.

Amazon Pay counts Ola, Box8, Faasos, and redBus among several others as partners. On the lines of WeChat, it wants to build an ecosystem with the help of these partners on top of its payment play.

Since Tapzo was a super app in the past, its team would help Amazon’s plan with experiences and lessons of running ecosystem of apps. It’s worth noting that Tapzo itself miserably failed to make any dent with apps aggregation model. Lessons learned by Tapzo must prove handy for Amazon while devising a strategy for the super app.

Harbouring dreams of becoming a super app among e-commerce companies isn’t a new phenomenon. Previously, Snapdeal also made an unsuccessful attempt to emulate WeChat’s DNA. Given that Tapzo and Snapdeal failed to crack the super app model, why Amazon and PhonePe think that they would be successful?

Also read: Tapzo is shutting down: Lessons to ponder for entrepreneurs

The probable answer for PhonePe and Amazon’s (via Amazon Pay) bullishness about super app is payments. Payments have many use case. For example, if you use PhonePe as primary payment mode and use it frequently for cab bookings, online food ordering and other offline as well as online transactions. In that case, PhonePe sees the opportunity to keep users inside the app.

Amazon and PhonePe want users to use many apps inside their ecosystem instead of keeping those apps on their phone.

Secondly, amidst high uninstall rate, digital commerce companies spend a major pie of marketing budget on driving installations, creating awareness and incentivise users to make them transact.

Amazon and PhonePe are convinced that this is a win-win opportunity for both and the partner companies. The creation of a super app inside a payment app brings direct and assured business to the partners. Here the attraction goes beyond basic vanities (downloads or engagement).

Acquiring the customer (that actually transact) is getting expensive for companies, mini-app ecosystems would open access to millions of Amazon or PhonePe’s user base.

Despite all the aforementioned merits, cracking WeChat’s super app strategy is not easy in India where customer prioritizes discount and cashback over convenience. Will Amazon and PhonePe be successful in swimming through these unconquered waters? Let’s wait and watch.