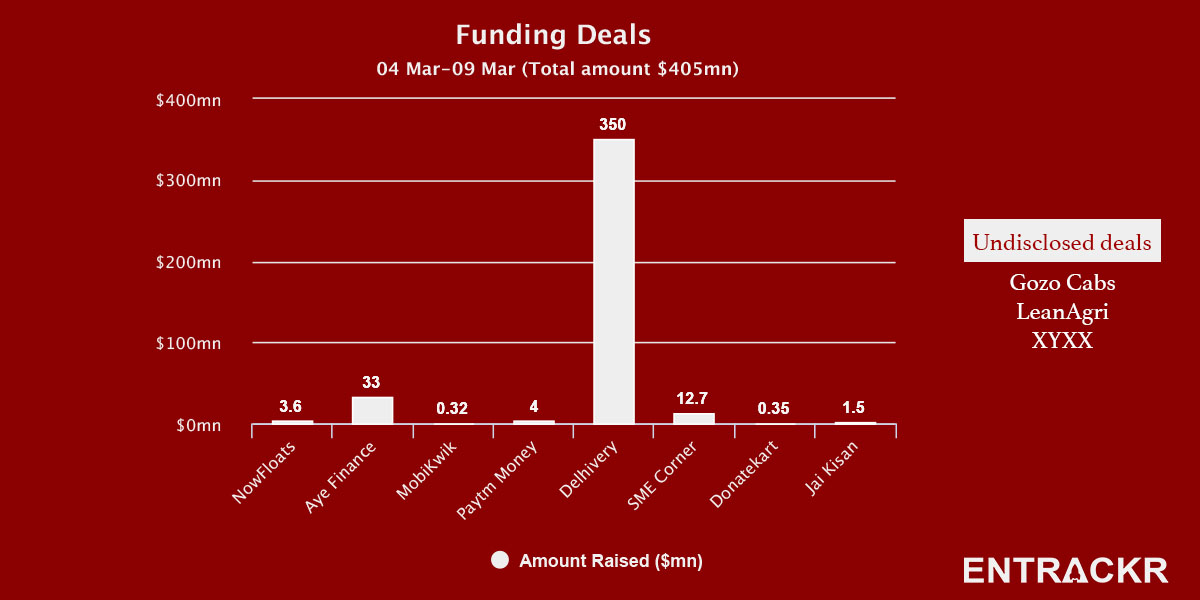

This week 11 Indian startups received funding, of which 8 received a total sum of about $405 million. Among them, Delhivery raised the highest funding of about $350 million followed by Aye Finance, which raised about $33 million.

Meanwhile, funding for 3 of the total funded startups remained undisclosed.

Below is the summary of deals closed this week:

NowFloats: Hyderabad-based NowFloats, which helps local businesses get online, has raised $3.6 million debt round from existing investors Iron Pillar, On Mauritius, IIFL and others.

Aye Finance: MSMEs-focused lending platform Aye Finance has raised about $33 million in Series D round led by Falcon Edge.

MobiKwik: Two Senior Directors at the US-based networking hardware company Cisco have invested $0.32 million in Mobikwik.

Paytm Money: Paytm’s wealth management platform Paytm Money has received fresh fund of about $4 million from the parent entity – One97 Communications.

Delhivery: Masayoshi Son led SoftBank Vision Fund has committed to invest $350 million in Delhivery.

SME Corner: Digital lending platform SME Corner has picked up $12.7 million in a mixed round of equity and debt. Accion Frontier Inclusion Fund managed by Quona Capital put in Rs 35 crore whereas existing investors including Accion Venture Lab infused Rs 10 crore in the Mumbai-based startup.

Donatekart: Online charity platform Donatekart has raised $0.35 million in a seed funding round led by LetsVenture.

Jai Kisan: Farmer-focused fintech startup Jai Kisan has raised $1.5 million in a seed round led by early stage investor Blume Ventures, Prophetic Ventures, Harshbeena Zaveri (NRB Bearings), Better Capital, Astarc Ventures, Sanjay Mariwala of OmniActive, and others.

Undisclosed deals this week

Outstation taxi service provider Gozo Cabs, Agri-tech startup LeanAgri, and eponymous innerwear brand XYXX did not disclose their financial details on funding.

*Every week we track startups that have raised fresh investment. Stay tuned for next week funding roundup