Whenever an aspiring entrepreneur devises a thought out plan to create a disrupt in the market, the first thing that he requires to execute that plan is financial support. Gone are the days when an entrepreneur relied on family money or mortgaged their personal assets to finance their brainchild.

These days, the financial backbone of the Indian startup ecosystem is the Venture Capital industry and the network of Angel or High Net Worth Individual (HNI) investors.

When we study the rewards that 2018 has seeped for this backbone of the startup ecosystem, especially with respect to the Internet economy, it seems that things have started looking up for these high-risk investors.

Last year is marked as the year when the market disrupt has finally reached the VC industry, and several companies have taken the initiative to let their investors start a fresh cycle of fund circulation. A fund, that had been earning the valuation rust in their own balance sheets.

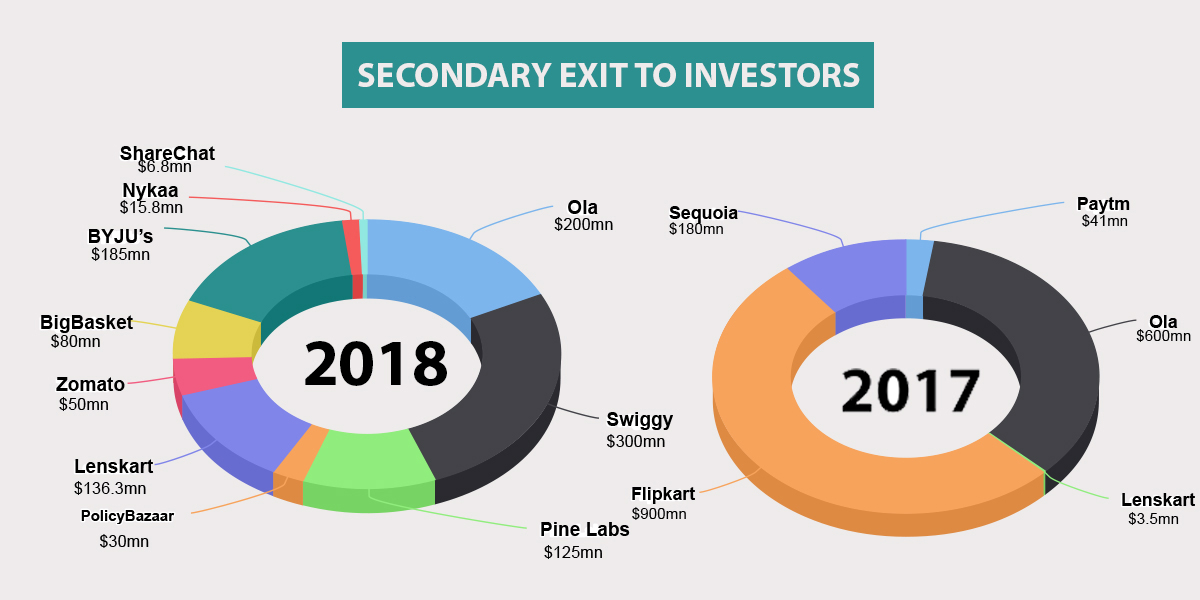

The year, altogether, saw institutional investors, HNIs, and venture capitalists making over $1.129 billion via secondary share sales in several of the famous tech-based startups.

The largest of these rounds was delivered by Swiggy. The foodtech giant facilitated a staggering $300 million climax to the year where its existing investors including Norwest Venture Partners, Accel Ventures, Bessemer Ventures, and SAIF Partners sold their stakes to RB Investments, Harmony Partners, Naspers, Tencent, Meituan, Coatue Management, and DST Global.

Other significant deals involved cab-hailing major Ola’s $200 million secondary share sale, eyewear e-tailer Lenskart’s $136.3 million worth two rounds of secondary funding, edtech major BYJU’s $185 million deal which was a part of $540 million funding round.

While these are impressive figures that the investors earned during the year, the better part to note about these deals in FY18 is the number and age of companies that participated in such transactions. Firms from all sectors and age groups like Zomato, Pine Labs, Policy Bazaar, BigBasket, Nykaa, Firstcry, Unacademy and Sharechat also facilitated stake sale in, albeit, smaller numbers.

Last year’s figures are exclusive of the Walmart-Flipkart deal whereby the global retail giant acquired India’s highest valued e-commerce startup in a $16 billion deal.

When compared to 2017, the total volume might be lesser, but it was still more spread out. In the year before 2018, the total money made by investors in secondary deals was $1.724 billion. However, $900 million of this made by investors during Softbank’s infusion of $2.4 billion in Flipkart alone. Rest of the amount was made out of a few heavy deals in Paytm, Ola, Lenskart.

The due rewards

While this was all about how day by day the Indian startup ecosystem is becoming a better place for investors, another group of stakeholder that works hard to ensure the success of this industry isn’t devoid of the benefits of monetary rewards as well.

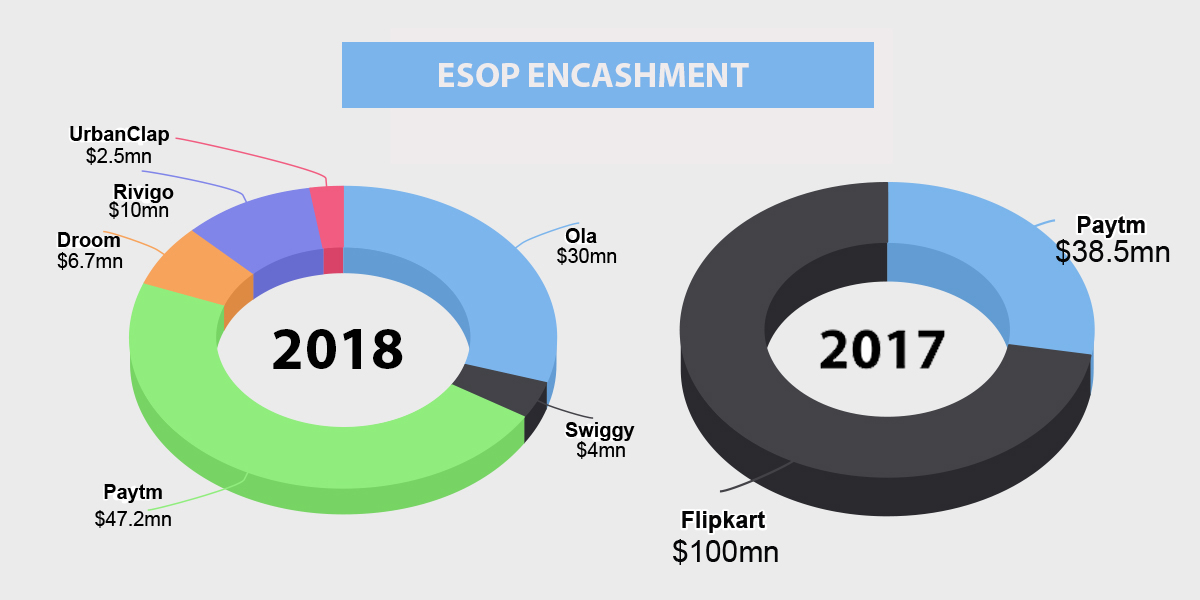

Yes, we’re talking about how several companies like Rivigo, and UrbanClap brought a revolution in the Employee Stock Option Plan encashment practices during 2018, rewarding the hardworking employees with a monetary appreciation which was long overdue.

In September, formidable logistics startup Rivigo allowed 30 of its employees to cash out ESOPs worth Rs 71 crore ($10 million). The special part about this transaction was how the company became the first in the economy to allow its employees to sell their stakes without putting any cap on the number of shares they could sell in one go.

Similarly, in UrbanClap’s unique ESOP plan whereby employees received shares at the same strike price irrespective of their age in the company, the staff members got to encash their ESOPs in December 2018 without caring about any holding period and earned anywhere between lakhs to a crore.

OYO, India’s largest budget hotel chain might not have facilitated ESOP encashment till now, however, it took a major step to allow 2,000 more shares to be added to the ESOP pool. It has also offered to buy back Rs 50 crore worth shares from employees. In the upcoming 2-3 years, this secondary transaction is expected to go up to $150-200 million.

Overall, employees across several companies including these two, Paytm, Razorpay, Droom, Ola, and Swiggy earned more than $100.4 million throughout 2018. And again, while this amount was lesser than the $138.5 million in 2017, it was more spread out as opposed to $100 million being earned by only Flipkart employees in the previous year.

For Flipkart employees, there is more money on its way, as Walmart is obligated to buy back ESOPs worth more than $800 million in the near future as a part of the FK-WM deal. Employees across all the entities of the marketplaces’ group companies – Flipkart, Myntra, and Jabong – are expected to earn hefty amounts out of this transaction.

The domino cycle

As great as it is that the number of secondary exits and ESOP encashment is increasing and the stakeholders are getting aptly rewarded, that is not all that these events are good for.

Every time an event is reported where a company has facilitated any transaction by which investors and/or employees return home happy, it becomes a motivation for the competitors to take a similar initiative.

More than a motivation, it also becomes a requirement as the stakeholders are bound to flock towards rewards, and in turn, so is the efficiency and optimum performance. In a sense, one such event creates a layer of domino effect, giving birth to more and more secondary transactions or buyback of shares.

In a country like India, where IPOs are rare, secondary exits, complete or partial, become the best alternative for investors to gain returns on their investment.

Further, as Entrackr has also mentioned in previous articles related to the topic, this money returns to the ecosystem as the investors and employees invest this money back in the form of venture capital, venture debt, or angel investment.

This money again multiplies with time, and goes into the pocket of these stakeholders, and is reinvested; creating another cycle money circulation within the ecosystem.

Plus, this way new entrepreneurs keep getting a chance to rise in the Indian startup industry, instead of the money staying in the pocket of a few big players.

The flip side of the coin

It is a fair understanding that in unsuitable circumstances even the best of advantages can turn into a bane. The same motivation to facilitate a secondary deal in order to retain investors and employees and not lose them to a competitor can backfire, if the company doesn’t actually have the resources to do the same.

For instance, if a company’s out looking for investment when it’s existing investors haven’t been earning returns, while it’s competitors’ investors are, forget new, even the existing investors will be unlikely to pour in more money in the same firm. Similarly, if employees aren’t earning rewards, they might want to shift to the next best firm and get better rewards for same or a little more work.

In such a case, the enthusiasm of both the top level and the employees will tone down with time, creating a complacent environment within the workspace which will eventually negatively affect the performance further.

Talking about the side effects of these exits that have already taken place, is the overwhelming number of firms that are seeing top-level rejigs. While not all these rejigs are directly related to secondary transactions, a lot of top-level execs after earning back the money and efforts they invested in a firm leave to become entrepreneurs or take up larger positions in other firms.

Even if the factors governing their exits are different, the fact that they can make multifold returns on their money in exchange for leaving the firm becomes a compensation that motivates them to take a leap. The prime example of this are both the founders of Flipkart.

All’s well that earns well

There are several ways with the top level management to discount for these disadvantages and keep the firm functioning.

However, the benefits that are attached to a secondary transaction that allows the two most important stakeholders in the startup ecosystem, remain unmatched. The importance of these deals and buy-backs cannot be emphasized enough.

Although 2019 has started and it is yet to see any such deal, there are several in talks. Hopefully, the graph of secondary deals and ESOP encashment that took an upward turn in 2018 wrt the number of companies participating keeps up the trend, and 2019 presents an even better picture.

Alas, all’s well when the stakeholders earn well.