Startups in India witnessed about 36 per cent rise in Private Equity (PE) and Venture Capital (VC) investment last year.

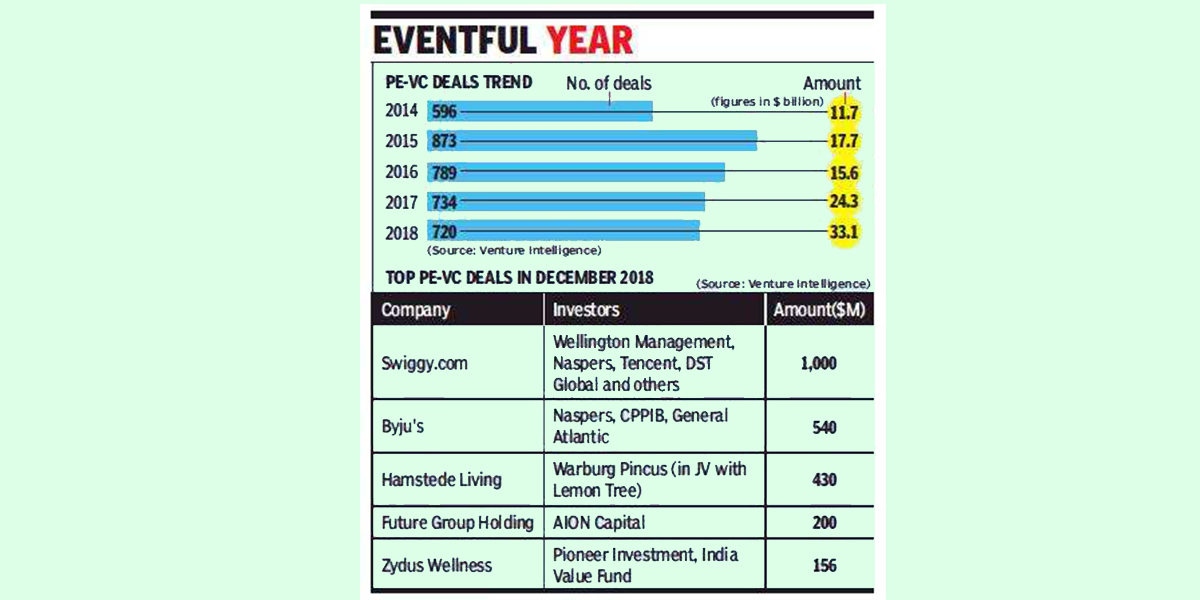

The total investment clocked around 720 deals worth $33.1 billion, according to data from Venture Intelligence. Last month alone witnessed 43 deals valued at $3.2 billion, almost double the value of investments raised in the same period last year. In 2017, the industry saw investment in 734 deals worth $24.3 billion.

Last year, investors showed a more selective approach and made higher value bets. Around 81 investments valued at $100 million, which 72 per cent of rise in compare to 2017.

Out of these deals, almost half of them were larger than $200 million each, compared to just 30 such investments in the year-ago period, added data.

This led to the making of several local Unicorns including Oyo, PolicyBazaar, Swiggy, Byjus, Udaan, BillDesk, Freshworks and Paytm Mall.

Walmart-Flipkart deal in mid last year brought back global investors attention to India and its big untapped market, said Arun Natarajan, founder of Venture Intelligence to ET.

The year was also better in terms of exits for PE-VC industry. The value of exits saw 78 per cent increase from last year to $25.4 billion.

IT and IT-enabled services companies accounted for close to 33per cent of the investment share, the research data further said.

This included Swiggy and Oyo $1 billion raise, $300 million by BillDesk from Temasek and others, $236 million raised by insurance aggregator PolicyBazaar, $325 million by BigBasket and $410 million by Zomato, $225 million by Udaan.

The Venture Capital (VC) investors in India have recorded a four-fold rise in exits in nine months this year, another report had said. Last month NITI Aayog CEO Amitabh Kant had also emphasised that the country needs to encourage domestic VC investment in Startups as less than 10 per cent of our VC investments come from domestic investors.