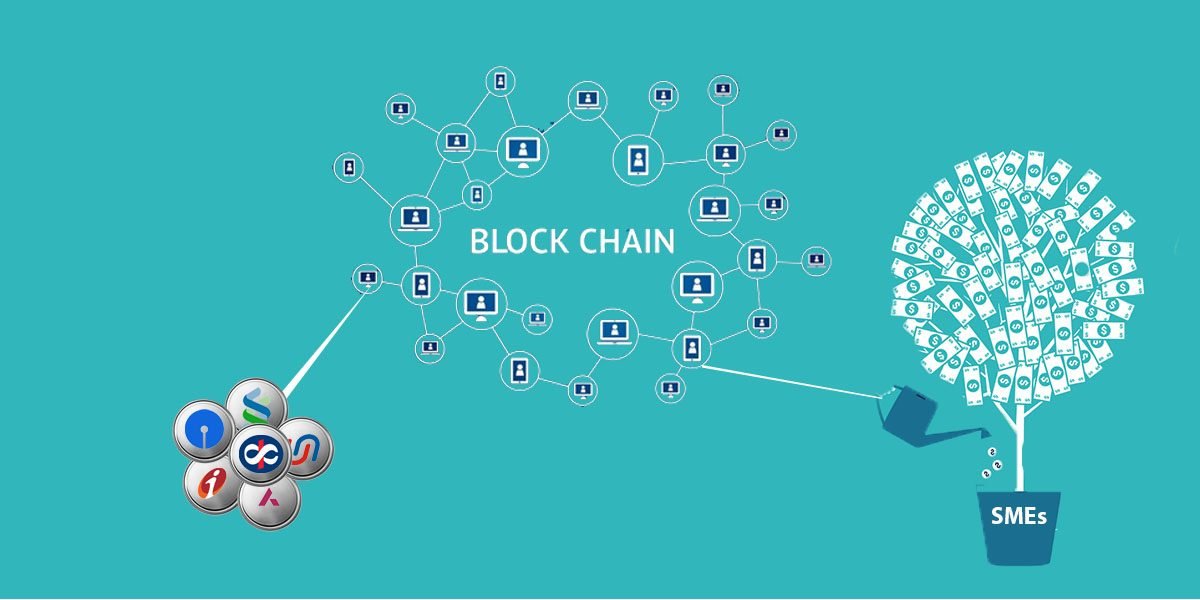

A consortium of eleven major banks are teaming up to start India’s first blockchain-linked funding for small and medium enterprises (SMEs).

The participating banks include ICICI, AXIS, HDFC, Kotak Mahindra, YES Bank, Standard Chartered, RBL, South Indian Bank, IndusInd Bank, State Bank of India and Bank of Baroda. Three banks including IndusInd Bank, State Bank of India and Bank of Baroda are currently now participating as outside members.

All these banks will set up a live network that will remove the communication barrier and cut time frame in supply-chain financing.

The main objective of blockchain-linked funding is to ensure transparency in credit disbursement, especially in the underbanked section, according to Abhijeet Singh, head of business technology at ICICI Bank

Once in place, the initiative will be more transparent and secure on a single network. Generally, a blockchain is a centralized ledger of all transactions across a peer-to-peer network. Using this technology, participants can confirm transactions without the need for a central certifying authority.

The system will happen in phases. In the initial phases, the banks will set up a live network for supply-chain vendors from across the country to register themselves and digitise their records.

The Blockchain Infrastructure Company (BIC) has been organising consortium on the blockchain.

Bankers believe that a new industry-wide blockchain-based system will help them reduce cost and deepen their credit catchment area by getting more SMEs into the formal credit system.

As per the latest central bank data, the outstanding credit of all commercial banks with the MSME sector as a percentage of the total outstanding corporate credit with banks is just 17.3 per cent.