Finding a right balance in your financial management is always a challenge. How not to spend your hard earned money can be a lesson that could fetch you long-term benefits in life. This is where the financial advisors come in, which has now been replaced by mobile financial service platforms.

The success of Times Internet-backed mobile financial service platform ETMoney heralds a paradigm shift in the segment. ETMoney has crossed two crore transactions with a 4 million customers base. From investments to insurance to borrowing, ETMoney helps a consumer manage the overall finances.

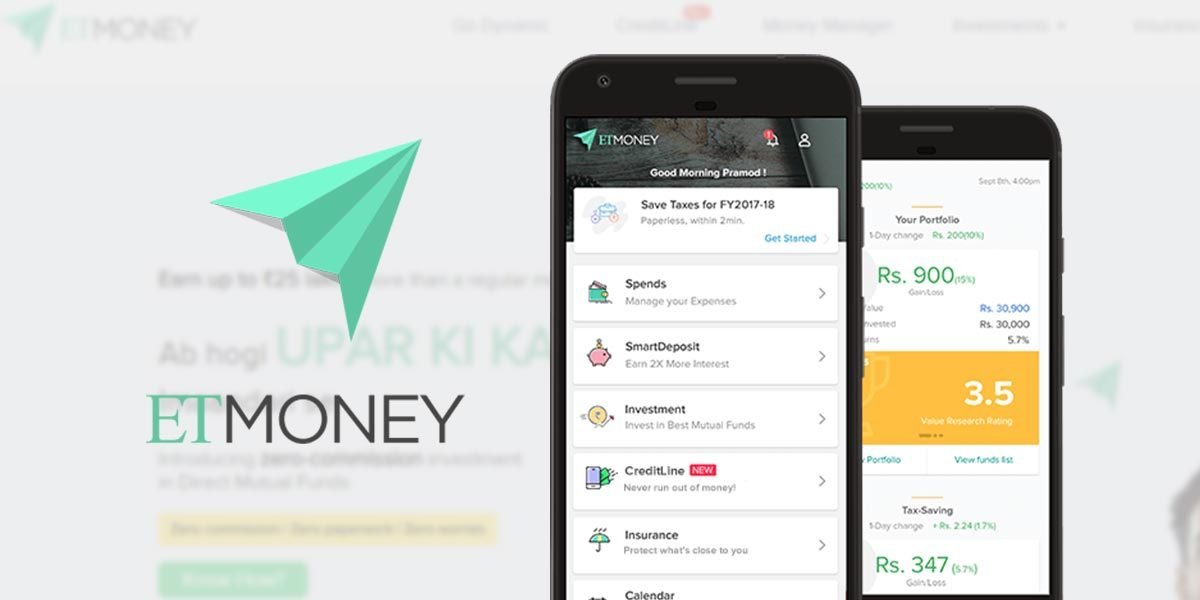

Founded in 2015, the expense management app broadly offers financial products including mutual funds, instant loan, gold deposits, liquid funds and insurance. It offers the customer to manage expenses, with one-tap auto-payments and real-time portfolio tracking and insights.

It has mutual funds investors 15 cities in India other than metros. Within two years of its launch, it did mutual fund sales of around Rs 500 crore.

“We have already processed over 2 crore investment orders through our platform,” said Mukesh P Kalra, CEO of ETMoney.

On Monday, ETMoney announced that it is shifting its platform to enable investments in zero-commission, direct mutual funds which can help save up to 1.5 percent in commission for users. Users can now invest in these direct plans of over 1000 mutual funds from all top mutual fund companies.

To claim this one-time opportunity, users need to open a Free Forever Investment account on ETMoney soon for getting unlimited and lifetime free transactions in direct mutual funds. The app has embedded seamless switch facility for all investments that can help shift its existing users to direct plans and start saving in commissions instantly.

Through it, ETMoney claims to save commission up to 1 lakh per year. In the online mutual fund space, it claims to have an advantage over its competitors such as ICICI Security and HDFC. ETMoney claims to have 15 percent of online market share in India.

ETMoney also offers instant loan through Creditline, which was launched in April, in partnership with RBL Bank. The interest on the loan ranges from 13 to 18 percent.

“We have simplified the KYC process. It is paperless and is done within minutes,” added Kalra.

At present, ETMoney is not thinking about monetizing its product. “We will do it at right time. Currently, we are focused on being a consumer-based platform,” said the CEO of the platform.

App-based sellers of financial products and Indian market

Financial products and insurance is an emerging sector and expected to be the next big thing in India. The online penetration of financial service like insurance is pretty low that makes the sector a hotspot for the new players in the vertical. Over 90% of insurance still take place offline through agents.

Among many financial services, the mutual fund industry alone is expected to grow from current 20 million investors to over 50 million investors in the next five years. The segment has attracted e-commerce players like Flipkart, Paytm and Amazon.

In June 2017, Flipkart had announced that it will be foraying into financial sectors. It plans to offer end-to-end transactions such as discovery, payment, delivery and post-sale services. E-tailer also incorporated a new firm for new businesses such as venture capital funding and insurance called Sabin Ventures.

On the lines of Alibaba’s payment affiliate Ant Financial promoted money market fund Yu’E Bao, Paytm has launched its mutual fund app, Paytm Money, which would focus on building investments and wealth management products and services. It will offer SIPs for as low as Rs 100 in some of the schemes for small towns investors.

Paytm has tied up with 25 asset management companies such as SBI Mutual Fund, LIC, HDFC, Kotak Mahindra, including several others to offer direct plans of mutual funds.

PaytmMoney claims 8.5 lakh registered users and out of this, 65 per cent of the people are from the top 15 cities of the country. It will provide access to over 2,500 users a day and will increase this to more than 10,000 users daily over the next few weeks.

To take on competitors, US e-tailer Amazon is making strategic investments to build an ecosystem of financial products and services. In the last four years, it has invested around 104 million in fintech startups including Qwikcilver, Bankbazaar, Capital Float and Acko.

Being a global player, Amazon understands the space and know that fintech and e-commerce interaction is evolving and will play a big role. In the future, it may integrate personal finance and retail with its payment app Amazon Pay as it believes in building the ecosystem.

Clearly, the opportunity is large and offer space to accommodate multiple players in this segment.

Most of the platforms are still in the early stage. In a time when new and innovative products are getting rapidly accepted by users, it will be interesting to see if new players will build their own products or associate with existing players. Clearly, on this front, ETMoney has the advantage over its competitors.