Competition is brutal and always look for a chance to gain an advantage over peers. On Tuesday, multiple media reports surfaced unraveling that Housejoy had fired about 40 employees across senior functions.

While it could be a co-incidence, Housejoy arch-rival UrbanClap has just revealed that its revenue funnel has improved and losses squeezed in FY18.

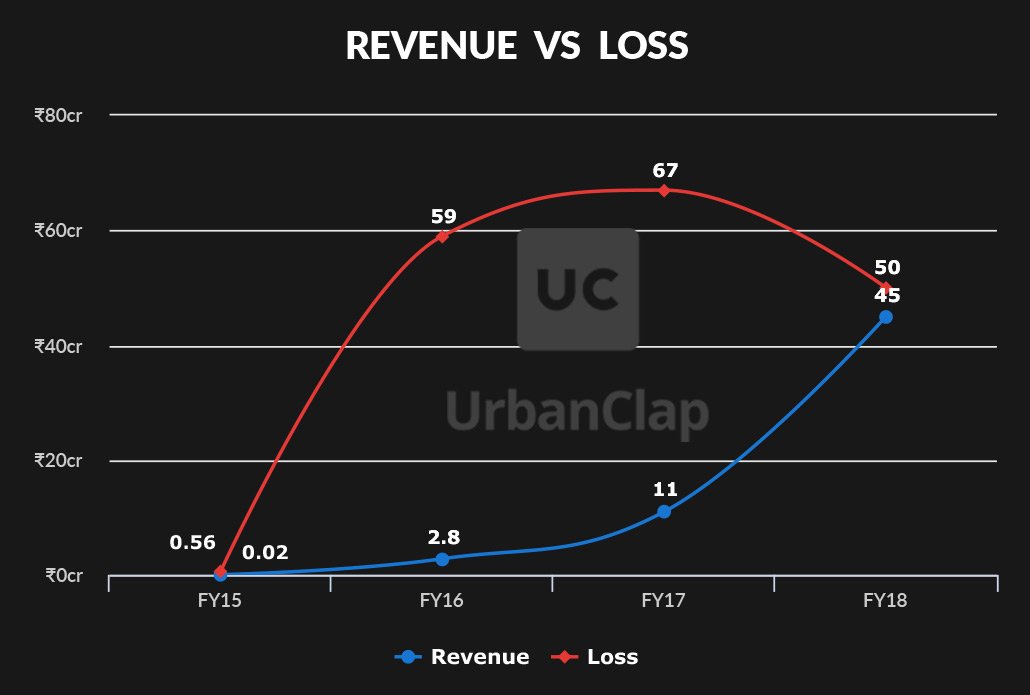

The Ratan Tata-backed horizontal service marketplace has recorded a 4X surge in revenue to Rs 45 crore in FY18 as compared to the preceding FY, reports Mint. Meanwhile, the company’s losses also witnessed a 25 per cent reduction in the recently concluded fiscal year than previous one.

UrbanClap had a total loss of Rs Rs 67 crore in FY17. Importantly, these figures are given by company not sourced from RoC filings.

The SAIF Partners-funded company primarily generates revenue through commission with a little component coming from product selling. It claims to make Rs 7.25 crore alone in April 2018 with a Gross Transaction Value (GTV) of Rs 50 crore, adds the report.

During the same period, it clocked an average transaction value of Rs 1,200 to 1,500 for each order. Beauty vertical contributes maximum revenue for the company followed by repairing of electric appliances and house cleaning.

Recently, Housejoy had laid off about 40 employees across mid-management functions including marketing, tech, and operations.

The move is likely in sync with controlling burn rate and improving unit economics. The Amazon-backed company is also eyeing to pull the plug from categories which aren’t performing and commercially unviable.

On the lines of UrbanClap, Housejoy also eyes on beauty segment. Ironically, the beauty vertical has been a major revenue generator for both companies while most of the startups that focused on this particular vertical went into oblivion.

With sprucing up its revenue and reducing losses, UrbanClap indeed appears to have an upper hand on the competition. However, still, it would take a long time to reflect right unit economics and achieve the holy grail – profitability.