Bengaluru-based P2P platform Instamojo, that provides on-demand payment for small medium enterprises (SMEs), has claimed to register significant growth in GMV, total seller addition, and net new active sellers this year.

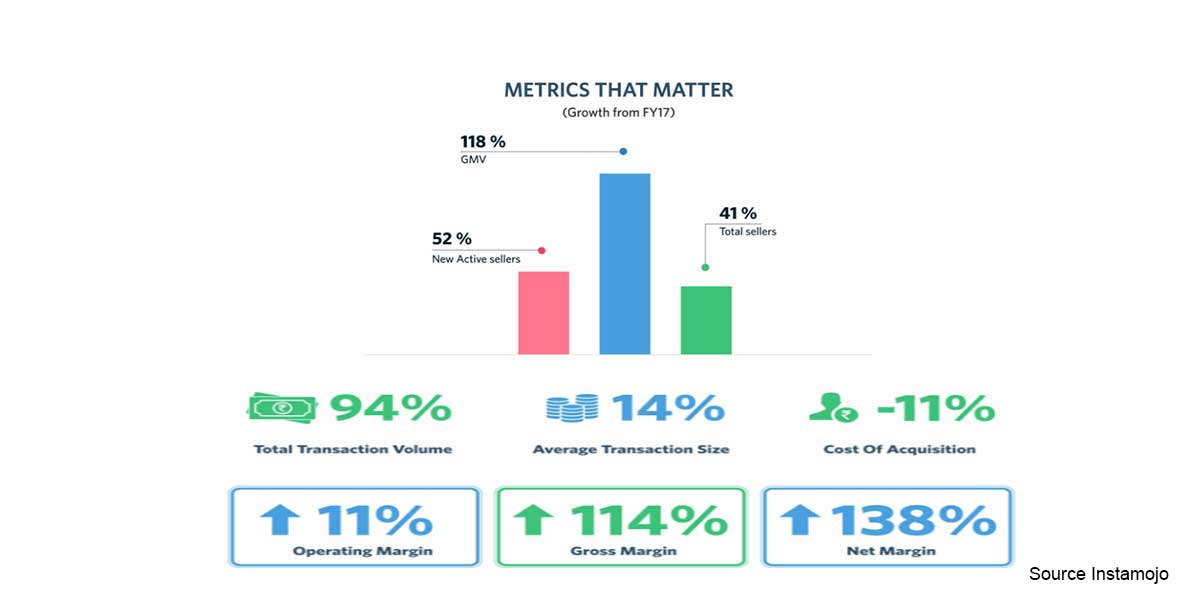

“Our core metrics like GMV, total seller addition, and net new active seller addition have grown by 118%, 41%, and 52% respectively in comparison to FY 17,” wrote Sampad Swain, CEO and co-founder of Instamojo on Instamojo blog adding first half of FY18 was the toughest period for the payment platform.

In last year, the platform processed 3 million transactions and has achieved an annualized run rate of Rs 1,000 crore.

At present, Instamojo has 400,000 SMEs using its payment service, and it is also targeting to onboard at least 1 million SME customers by the end of FY19.

“Other than being a platform with 10 lakh seller base, we want to add 100k new active sellers to become India’s largest online transactions platform,” added Sampad.

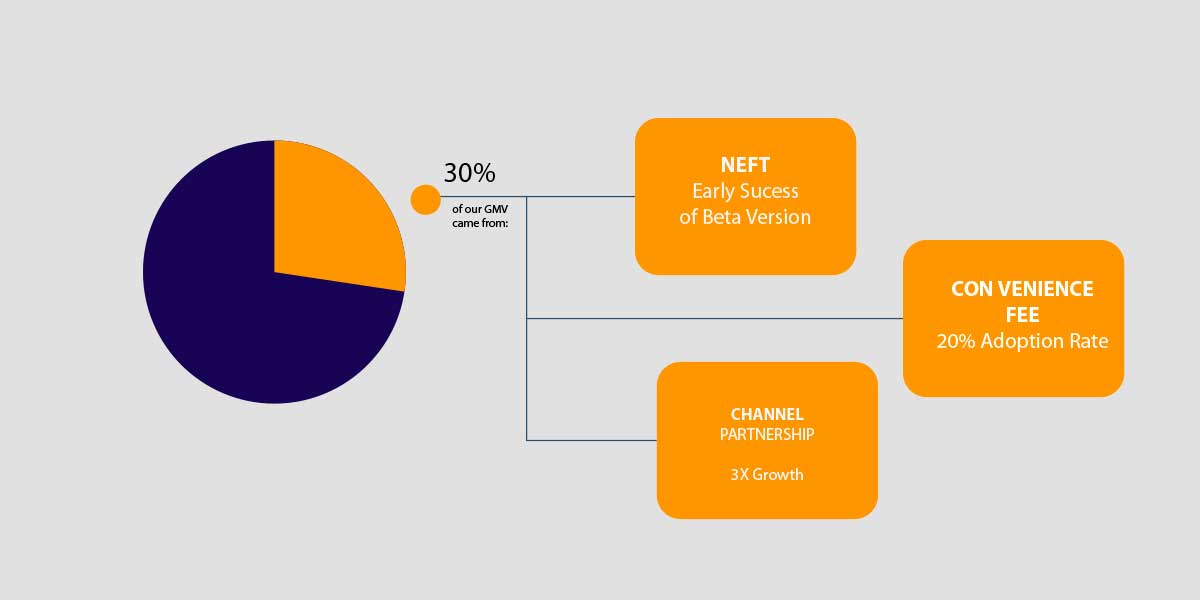

It also added over 30% of total GMV by new product launches like channel partnership program & convenience fee model by continuously listening to our users.

The firm has also recorded the falling of customer acquisition cost by 11% on a blended basis. It is also planning to foray in SME lending, where it plans to initially aggregate loans from NBFCs and banks. It will be looking at applying for an NBFC licence so that we can offer loans directly.

In 2019, it plans to make a transition to one-stop transactions platform with the launch of value-added services. “We will surpass a GMV revenue run-rate of Rs 6,000 Crores,” emphasised the founder of the payment platform.

It will also add four new products, which are claimed as game-changing products, namely Smart Links (payments), Instant Payouts (credit & lending), Integrated logistics services (shipping & delivery) and third-party apps integration (taxes, emails, invoices etc).

The startup was founded in 2012 by Sampad Swain, Aditya Sengupta, Akash Gehani and Harshad Sharma. It offers a link-based payments platform for individuals, micro-merchants, infopreneurs, freelancers, and SMBs to collect payment instantly.

Instamojo claims to cover 10% of the digitally active SMEs in India and enables about 30% of their turnover annually. Instamojo follows a commission-based revenue model, charging users 2% for use of its payment and e-commerce solutions.

In Aug last year, it has raised an undisclosed amount of funding from Japan’s payments firm Anypay. In 2014, Instamojo had last raised a Series A round of funding from Kalaari Capital, Blume Ventures, 500Startups and others.

Prior to that, it had raised around $500,000 from 500 Startups, Blume Ventures and a consortium of angel investors. Till date, it has raised $7 Mn in total from investors like Kalaari Capital, Blume Ventures and others.

Other players competing in the same segment, include Razorpay, PayU India, Paynear, CCAvenue and Oxigen.

Digital payments industry in India is projected to reach $500 Bn by 2020, contributing 15% to India’s GDP, according to a recent report by Google and Boston Consulting Group.