Homegrown e-commerce major Flipkart’s online battle with its counterpart in the country Amazon India has been growing day by day. To prove their leadership, both e-tailers have infused a huge sum of capital in recent times.

Now the SoftBank-funded company has claimed that it has a lead over its rival Amazon in terms of smartphone sales in 2017.

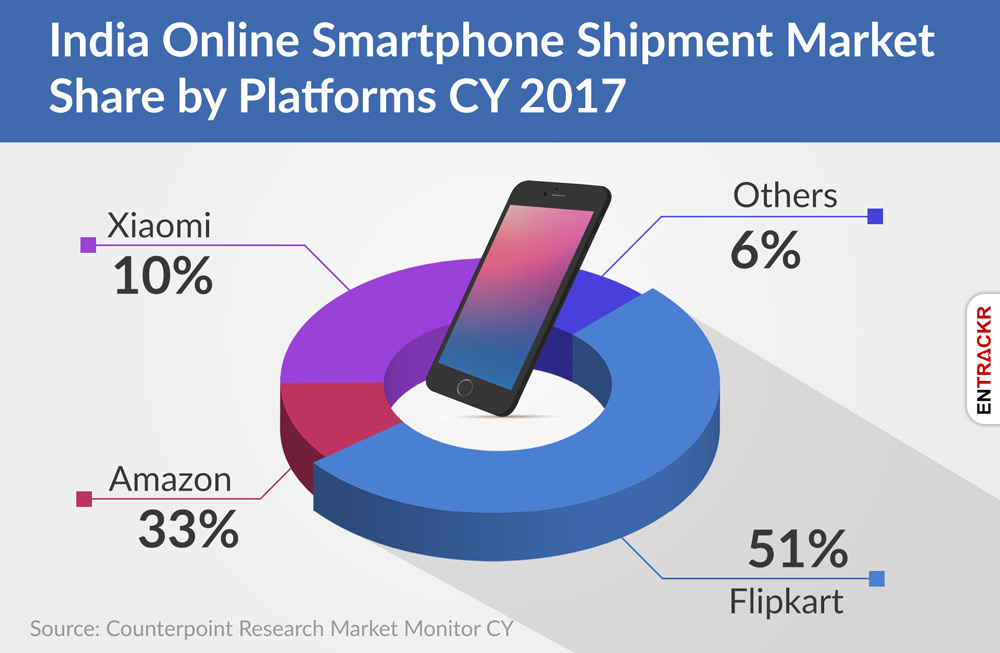

According to an ET report citing Counterpoint Research, the Bengaluru-based firm grew its market share of online smartphone shipments to 51 per cent in 2017, from 44 per cent the year before, while Amazon’s increased marginally to 33 per cent in 2017 from 31 per cent.

The report further added Indian online smartphone market shipments contributed to more than one-third of total smartphones sales during 2017 which has grown by 23 per cent annually.

Flipkart and Amazon have captured a combined 84 per cent of the total volume and 87 per cent of the total value. Online sale events like “Flipkart’s Big Billion” and “Amazon’s Great Indian Sale”, promotions and offers drove the market.

Chinese smartphone company which claims to be number one in India has contributed 10 per cent to overall online smartphone shipments during the same interval.

When it comes market share by brands, Xiaomi maintains its supremacy with 40 per cent share followed by another Chinese brand Lenovo and Samsung with 18 per cent and 15 per cent respectively.

Huawei, which in collaboration with Bharti Airtel conducted 5G trial test in India, is also making a significant dent with 3 per cent market share and rubbing shoulder with homegrown phone maker Micromax which is equal in the figures.

It is interesting to see three out of top five brands have come from China.

However, Ayyappan Rajagopal, senior director of smartphones at Flipkart statement’s doesn’t seem to streamline with Counterpoint’s research. He says that Flipkart has 70 per cent online market share and is growing 70 per cent year-on-year.

Reason behind Flipkart’s growth

“Exclusive smartphone models are the main heroes on online platforms, and whichever platform gets more deals will have more sales,” said Karn Chauhan, research analyst at Counterpoint.

Flipkart had 64 exclusives, with 158 phone models launched on the platform in 2017. Flipkart took lead in this with an exclusive launch of Redmi Note 4 in January 2017, while Amazon started exclusive deals only in April with Redmi 4A. This gave Flipkart the lead, the report added.

As far as the premium segment is concerned, Amazon had the upper hand in the category, which is in the price range above Rs 30,000. While Amazon contributed 63 percent to online smartphone premium segment shipments driven by sales of OnePlus and Apple, Flipkart’s contribution was 31 per cent in the same segment.

Flipkart-Amazon battle

Of late, the Bengaluru-based e-tailer has been focusing on boosting market share rather than narrowing its losses. For the financial year ending March 2017, Flipkart widened its losses by 68 percent to Rs 8,771 crore. Flipkart had posted losses of Rs 5,223 crore in 2015-16.

Flipkart, which is under consideration of global retail major Walmart for a huge capital infusion, invested $257 million in its logistics arm eKart in January this year. The investment comes after it pumped in $147 million into the unit last September.

Amazon India which is jostling for market leadership also invested Rs 1,950 crore into its Indian arm Amazon Seller Services in January this year. In November 2017, the Seattle-based company had invested $450 million (Rs 2,900 crore) into Amazon Seller Service.

Flipkart and Amazon will keep fighting to grab the largest marketshare of fledgling e-commerce market which is slated to cross $50 billion in 2018.

In January, Amazon India claimed that it did twice the order processed by Flipkart during ‘Great India Sale’ (held during January 21-24). The company also claimed to acquire the highest number of new shoppers in any single online event (except Diwali Sales) ever.

However, Flipkart also stated that it has maintained a leadership position with 60-65 market share during ‘Republic Day Sale’ (held January 21-23).

Apart from the two biggies, Paytm witnessed modest growth in 2017, most of this coming from the huge discounts offered on high-ASP smartphones like iPhone.

While online smartphone market shipments contributed to more than one-third of total smartphones sold in 2017, Counterpoint expects the share of online to remain flat in 2018, citing the offline-online hybrid strategies of smartphone brands.