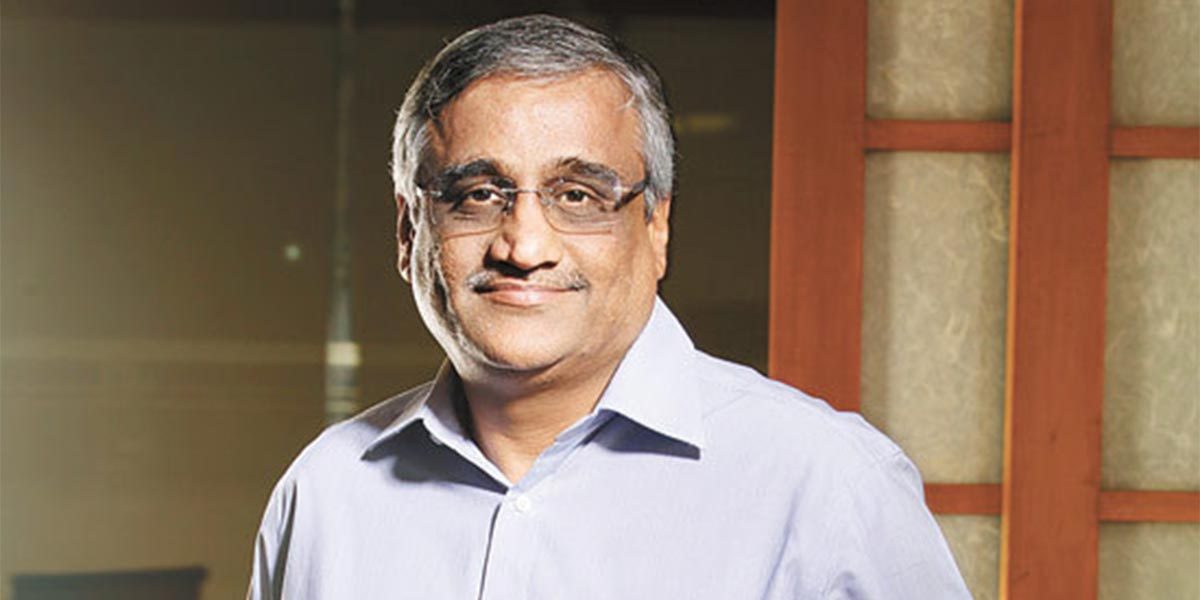

The logistics arm of Kishore Biyani’s Future Group, Future Supply Chain Solutions has raised Rs 195 crore by selling shares to institutional investors as part of its anchor book allocation ahead of its Rs 650 crore IPO, which begins today.

The list of anchor investors has some prominent names, such as L&T Mutual Fund Trustee Ltd, Reliance Capital Trustee Company, and HDFC Trustee Company, among others.

In the three-day offer, the company will issue up to 98 lakh equity shares at a price band of Rs 660-664 apiece. At the upper end, it will command a valuation of Rs 2,660 crore. Bids can be made for a minimum lot of 22 shares and in multiples of 22 thereafter, reported Bloomberg.

One of India’s largest organised third-party logistics service operators, Future Supply Chain will become the group’s sixth firm to go public. Other listed firms are Future Retail, Future Consumer, Future Market Networks, Future Enterprises and Future Lifestyle Fashions.

Also Read: Physical retail is future and threat to online retail: Kishore Biyani

The end-to-end supply chain and logistics company, Future Supply Chain Solutions Ltd was incorporated in April 2007 and is promoted by Future Retail. The company has a presence in three business segments – contract, express, and temperature controlled logistics.

It offers warehousing, distribution and other logistics solutions to customers across industries such as retail, fashion and apparel, automotive and engineering, food and beverage, fast-moving consumer goods, e-commerce, healthcare, electronics and technology, home and furniture and ATMs.

Also Read: E-commerce companies will never turn profitable: Kishore Biyani

In fiscal 2017, the logistics firm had reported a profit of Rs 45.7 crore as against Rs 29.4 crore in the previous year.

The company has hired Edelweiss Financial Services Ltd, CLSA India Pvt. Ltd, Nomura Financial Advisory & Securities (India) Pvt. Ltd, IDFC Bank Ltd, IIFL Holdings Ltd, YES Securities (India) Ltd to manage the IPO.