Digital transactions in December touched 1.06 billion mark in volume, rising 6.06 per cent from 997.1 million transactions in November, according to provisional data released by the Reserve Bank of India (RBI).

Digital transactions include payments through credit and debit cards, the unified payments interface (UPI), unstructured supplementary service data (USSD), prepaid payment instruments (PPIs) and internet banking.

The total digital transaction value reached the second-time high with Rs 125.51 trillion in December. In March 2017, the total value hit the highest mark with Rs 149.59 trillion worth of transactions.

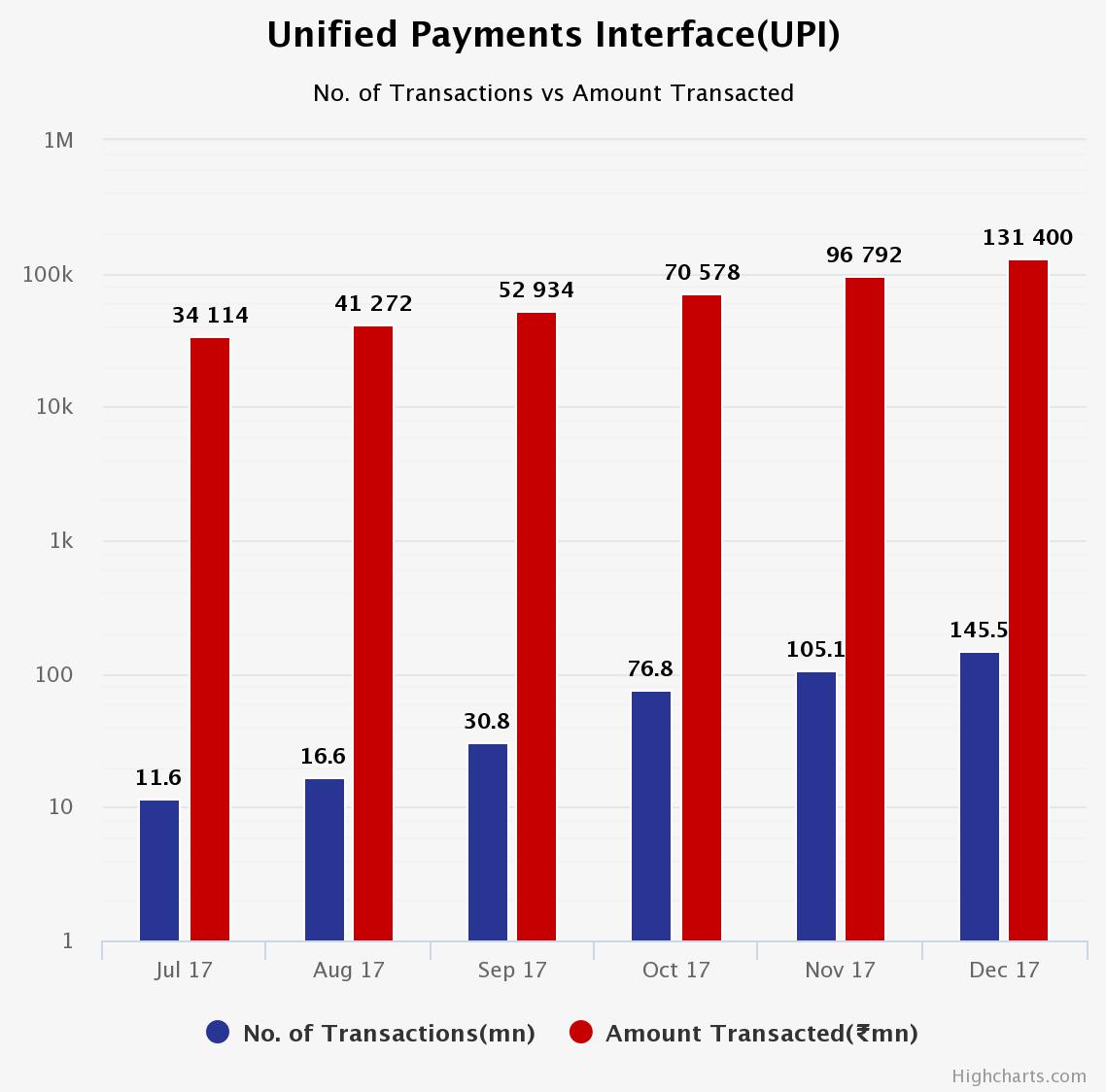

UPI transactions (Unified Payments Interface) saw an increase of about 38 per cent in total transaction volume with 145 million transactions in December 2017.

Meanwhile, the value of transactions rose about 36 per cent to Rs 13,174 crore in December from Rs 9,679 crore in November. The number of monthly transactions stood at 105 million in November period.

Despite the increase in the number of UPI transactions, the average ticket size of a UPI transaction slightly decreased to Rs 908 in December from Rs 921 in November 2017.

In the last one year, the UPI transaction volume has risen by more than 7000 per cent, according to RBI data.

Currently, there are 61 banks live on Unified Payments Interface platform, however, a major portion of transactions are being driven by smartphone-based payment applications such as Google’s Tez, Flipkart-owned PhonePe and Bharat Interface for Money (BHIM).

However, when other UPI platforms witnessed a massive growth, the government-promoted BHIM app grew at a slow pace. It recorded only 8.2 million transactions in November 2016 with a meager growth of 8 per cent from the previous month.

The growth of BHIM has remained almost stagnant month-on-month. In October 2016, it barely recorded 10 per cent growth in transaction volume.

Usage of PPIs such as mobile wallets peaked in terms of both volume and value during December.

The volume of PPI transactions in December 2016 was 99.1 million as compared with 96.2 million in October 2016 with Rs 35.1 billion and Rs 32.7 billion worth of transactions, respectively.

Debit and credit card usage at point-of-sale (PoS) machines rose both in terms of value and volume. The volume of transactions increased by around 5 per cent in December 2016 to 257.2 million transactions from 244.6 million transactions in the previous month.

Post demonetization, the government has been pushing to popularize digital payments.

Last month, the Reserve Bank of India (RBI) reduced the Merchant Discount Rate (MDR) for debit card transactions and prescribed separate cap for small and large merchants based on their annual turnover. The move was aimed to encourage merchants to accept online mode of payments.