After having banned from conducting Aadhaar-based SIM verification of cellular and its payments bank customers using e-KYC process, Airtel is temporarily relieved (till January 10, 2018) by the UIDAI to resume Aadhaar-based verification for its cellular subscribers.

Airtel Payments Bank continues to be barred from 12 digits biometric-based e-KYC verification, reports Mint. UIDAI recently barred Airtel and its payments banks arm to conduct an Aadhaar-based verification using e-KYC process.

Importantly, Airtel’s temporary relief came after it transferred Rs 138 crore to over 5.5 million subscribers in their originally linked bank accounts.

Last week, Airtel reportedly transferred about Rs 47 crore worth LPG subsidy in its 2.3 million customers’ Payments Bank account, which they did not know had been opened.

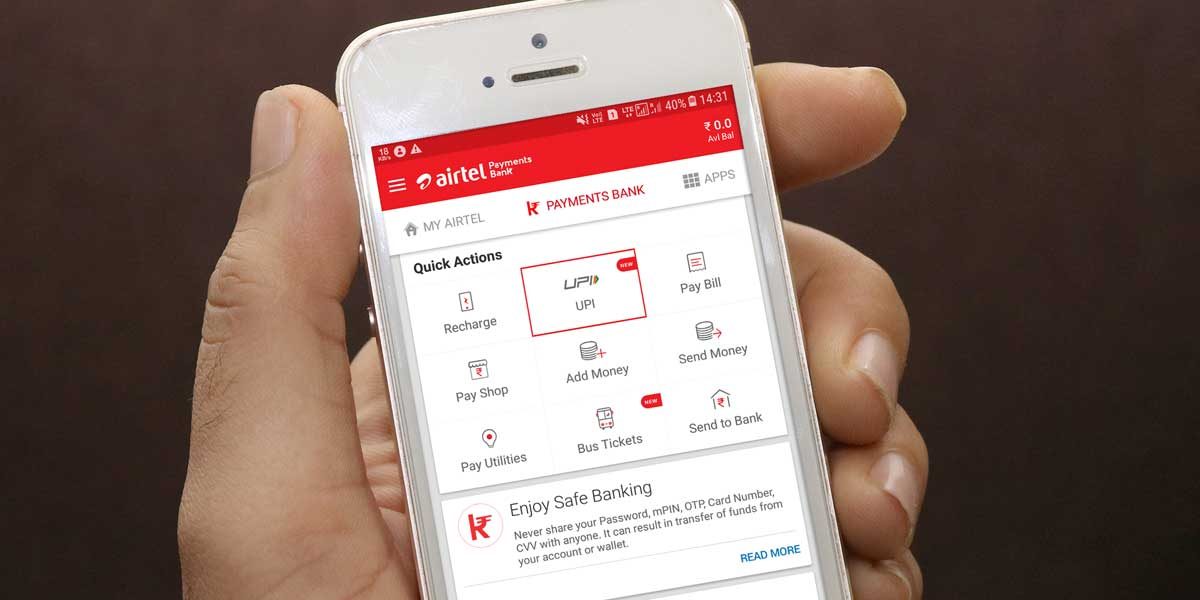

The company allegedly opened Payments Bank accounts for customers while conducting an Aadhar-based e-KYC verification for mobile connections. Security and privacy of Aadhaar data have been fiercely debated and the Supreme Court is currently looking into its various aspects.

The relief to Airtel comes at a time when government’s deadline to link Aadhaar with mobile SIMs extended to 31 March following the apex court’s directive. Notably, the company deposited Rs 2.5 crore as a penalty to UIDAI for violating its guidelines.

UIDAI has also asked apex banking body Reserve Bank of India (RBI), Department of Telecom (DoT) and audit and consultancy firm PricewaterhouseCoopers to conduct an audit to ascertain if Airtel’s systems and processes are in compliance with the Aadhaar Act or not.

The UIDAI will decide further course of action on 10 January 2018 after the submission of the audit report.

Earlier UIDAI reviewed the Airtel mobile app, and observed that when the app is opened – a welcome message is accompanied by a pre-ticked consent box with a blurb “Upgrade or create my Payments Bank wallet using existing Airtel mobile KYC.”

Such tactics are a blatant disregard of Aadhaar Act and Regulations. Meanwhile, UIDAI also issued strict rules asking banks and the NPCI to obtain the prior consent of beneficiaries before changing their bank accounts for Aadhar-based welfare scheme.