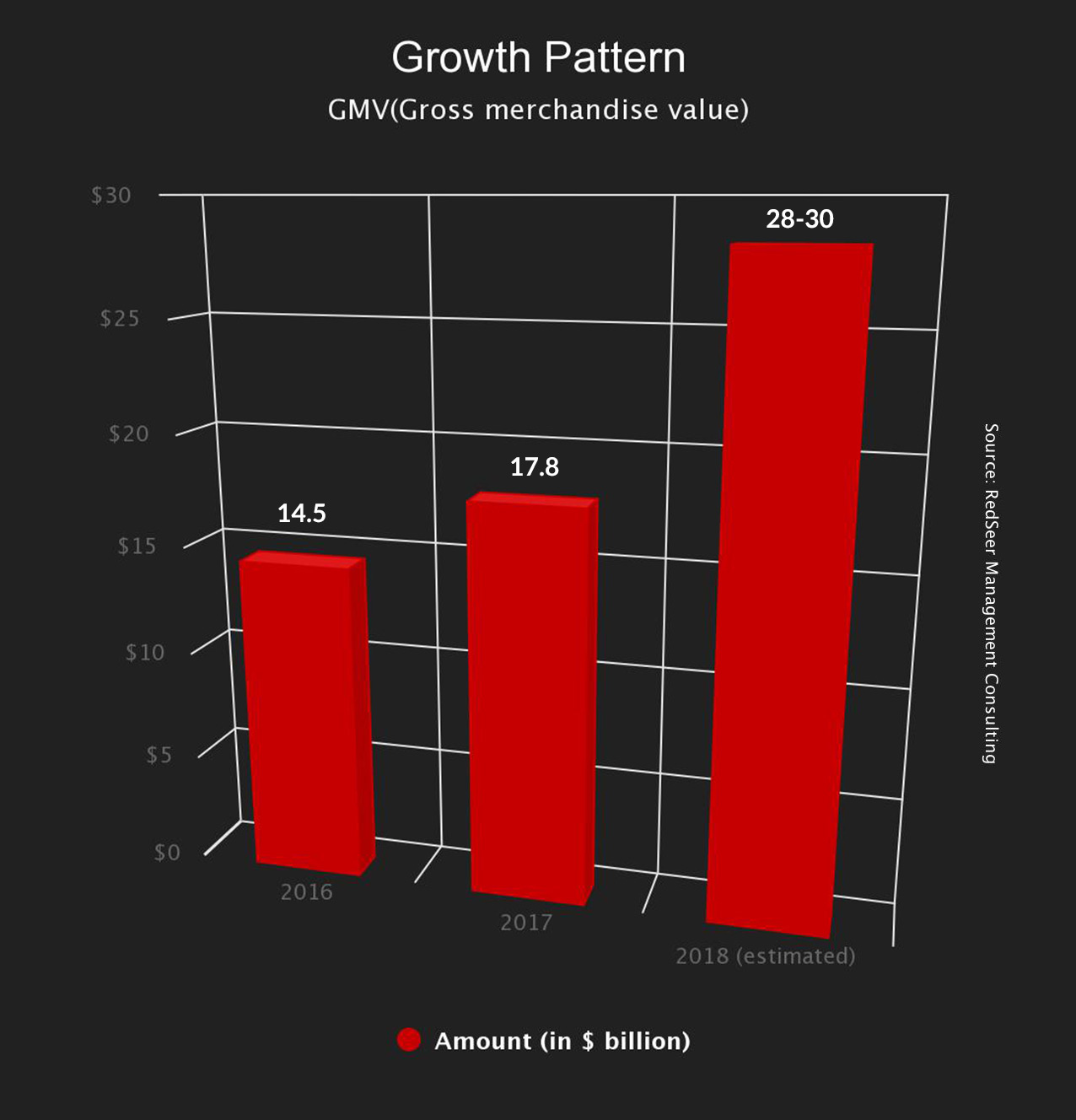

Driven by strong growth this year, online retail has grown by 23 percent to $17.8 billion in this year, which is more than $14.5 billion in Gross Merchandise Value (GMV), the value of goods sold on a site after discounts, last year.

Online retail is expected to continue its upward graph in 2018. The market is projected to increase by as much as 60 percent to 28-30 billion in GMV, according to RedSeer report.

“The market showed very strong growth in the second half of the year and we expect that to continue in 2018,” RedSeer chief executive Anil Kumar said. “It wasn’t just that sale months were (better than the year-ago period), even the non-sale months in the second half were much higher than H1. So there are enough signs that online retail should see very high growth next year.”

However, experts in the industry expressed different views on the growth of the market. They are still conservative about the growth. A joint study conducted by Assocham and Deloitte last week said that the e-commerce industry in India will cross $50-billion mark by the end of 2018.

The Indian e-commerce sector still witnesses a large dependency on the cash on delivery (CoD) mode of transaction. The study also added that CoD is the most preferred choice for Indian consumers due to lack of trust in online transactions and limited adoption of credit and debit cards. The market is still over-reliant on smartphone sales, which generate more than half of the GMV at top e-commerce firms.

Meanwhile, in 2017, the growth in e-commerce was driven primarily by Flipkart and Amazon, which now together account for a majority of online retail. Sales at Snapdeal, once the second-largest online retailer, collapsed as it cut costs to survive after a proposed sale to Flipkart fell apart. Growth was also boosted by additional sales events at Flipkart and Amazon and the heavy discounting at Paytm E-Commerce Pvt. Ltd, which raised $200 million from Alibaba Group Holding Ltd and SAIF Partners in March.

Flipkart, which owns the fashion retailers Myntra and Jabong, won the sale festival and consolidated its slender lead over Amazon India.

Amazon also had another strong year though it was bested by Flipkart in key sales events. The company’s subscription service Prime was at the centre of its India business as it signed up millions of Prime customers since the launch of the program in July 2016.

In 2018, both Flipkart and Amazon are expected to push deeper into smaller cities and towns. The two companies will closely monitor moves by Paytm particularly because it’s backed by Alibaba, whose India strategy is still unclear.

“The ongoing efforts by Flipkart and Amazon to go deeper into Tier 2 and Tier 3 cities and Paytm’s aggressive expansion plans will drive the market next year. Because of this, we should we see that growth will come more from new online shoppers rather than selling more to existing customers. In 2016 and 2017, it was the other way round—most of the growth was coming from existing users,” RedSeer’s Kumar said.