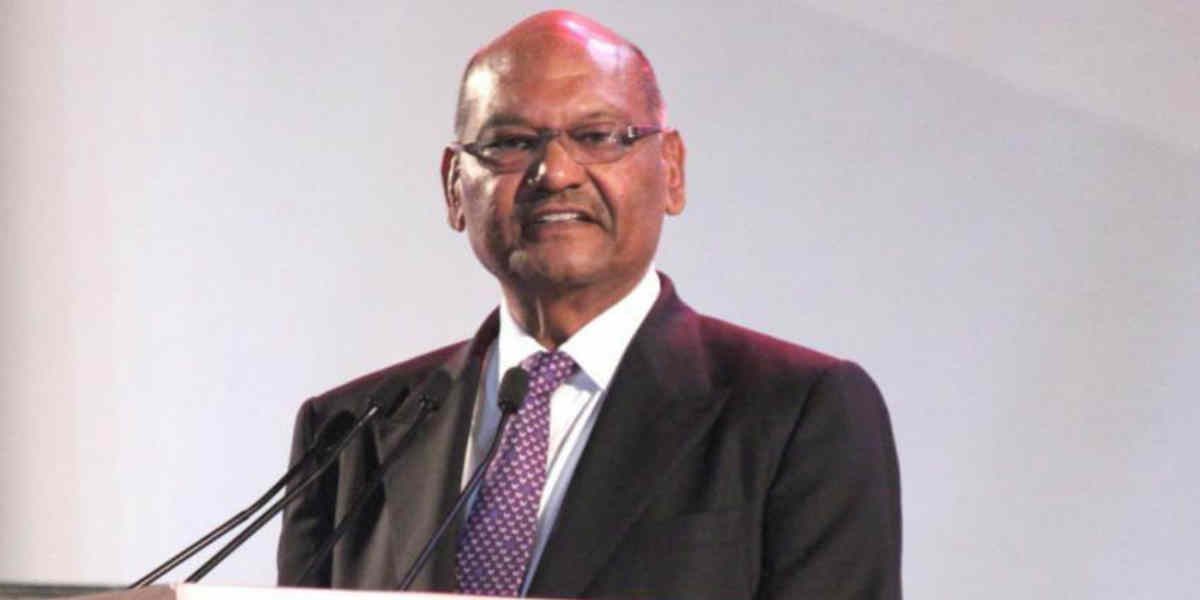

Mining baron Anil Agarwal of Vedanta, the world’s sixth largest diversified mineral resource conglomerate, is planning to launch a venture capital fund worth $1 billion to help young Indian entrepreneurs in the natural resources space.

Anil Agarwal is the latest to join the list of accomplished and decorated industrial billionaires taking an active interest in startups. It’s a list that includes Mukesh Ambani, N R Narayana Murthy and Azim Premji.

According to a Times of India report, the planned fund will back new ventures in the natural resources space, becoming the country’s first natural resources-focused venture fund established by an Indian industrialist.

Also Read: Young India needs right eco-system to be nation of million startups: Mukesh Ambani

Agarwal owned-Vedanta Group is the largest mining and non-ferrous metals company in India. It runs metals and energy businesses ranging from iron ore, copper, zinc, aluminum, gold, silver and diamond to oil & gas with revenues of over $15 billion.

“I only know my (natural resources) sector well. And so a partnership will help these ventures blossom in and around his Vedanta Group,” said Anil Agarwal.

“The structure under which the fund will be set up is yet to be decided. We are still debating if the fund will be through the company (Vedanta) or in an individual capacity,” he added.

Depending on the requirements, he will invest anywhere between Rs 5 crore and Rs 200 crore ($30 million) in select entities.

Also Read: Why Ratan Tata feels Indian startups are not as disruptive as global cos

Besides Wipro‘s Azim Premji and Infosys‘ NR Narayana Murthy, who have their own investment firms to back startups, Mukesh Ambani had announced plans for a Rs 5,000-crore venture startup fund to be set up through Reliance Jio to invest in digital businesses. Joining the league, Tata Sons Ltd chairman emeritus Ratan Tata, also set up a venture capital and Sajjan Jindal’s JSW Group, too, has a Rs 100-crore venture capital fund JSW Ventures.