To offer many services like loans and term deposit, Paytm Payments Bank will partner with full-service banks, said its CEO.

“Anything which we cannot offer, we will be partnering with the banks. Whether it’s going to be a loan, or a credit card, or a term deposit, and other services,” said Renu Satti, CEO of Paytm Payments Bank, to Reuters.

Due to RBI regulatory restrictions, the firm cannot offer certain services as of now. It can take savings deposits and remittances but are not permitted to lend.

Satti, however, did not divulge the name of the banks.

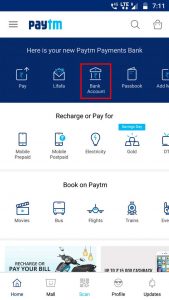

The Paytm Payments Bank is now available for all users, months after it was launched in May. Now, with the latest app update to Paytm 6.0.0, the bank is open to all users, on both Android and iOS. As of now, the service is only available through the Paytm apps.

Paytm on Tuesday launched its payment bank digitally on its mobile app, starting in beta mode on iOS. The bank account has no minimum balance requirement, though maximum balance is capped at Rs. 1 lakh. Paytm Payments Bank is offering interest at 4 percent per annum. It aims to build India’s first world-class digital bank and a new business model in the banking industry.

Founded in 2010 by Vijay Shekhar Sharma, the platform claims to have 220 million wallets.

Noida based company had recently raised $1.4 billion from Softbank at a valuation of $7 billion. The investment was one of the largest fund-raising events for any internet company in the country.

Sharma also owns 51% equity in recently launched Paytm payment bank along with 16% stake in Paytm. Recently, Sharma bought his dream home in Delhi Lutyens’ zone for Rs 82 crore.

Besides Reliance Industries, owned by Mukesh Ambani, and India’s top three phone carriers, are among others who won permits for payments banks.