Joining the list of firms interested in India’s National Payments Corporation of India (NPCI) run payments technology, Ride-hailing app Uber has integrated UPI (United Payments Interface) on its platform.

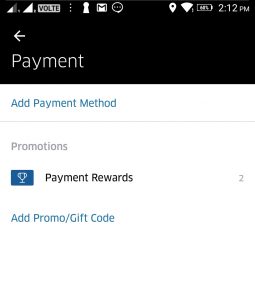

Cab users in India now can locate the new method as a payment option in the ‘Payment’ tab in Uber app. Whlie browsing through payment option in the app, one can tap on the ‘Add Payment Method’, then user will be asked to enter UPI ID. It charges Rs 1 to authenticate the ID. Finally the user gets authentication SMS form UPI service provider.

UPI Payment feature is not available to all Uber users.

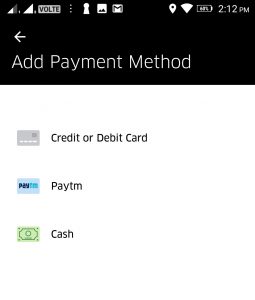

Entrackr tried to navigate through Uber app to get to UPI payment option, which was not visible or available on the app. It only showed option including Credit/Debit card, Paytm and Cash. There was no option of UPI. iPhone users will also have same existing payments options – debit, credit cards, and Paytm – as UPI integration is still not live on iOS.

UPI adoption by Uber on its platform is a major win for UPI, which is reportedly witnessing surge in its integration through apps such as Flipkart owned PhonePe and government promoted app -BHIM.

NPCI Managing Director and Chief Executive AP Hota expressed his optimism about the Uber’s supporting the UPI. Almost 60% of these cabs drivers still get paid in cash by customers, UPI payments will help Uber’s drivers in making payments , he said.

In a statement Uber spokesperson said that it sees UPI as the future of Indian payments.

However, Entrackr questions regarding the latest development by Uber, remains unanswered.

Among other global players, caller ID app Truecaller provides payments via UPI, while Facebook’s WhatsApp is planning to add UPI payments support soon. Uber’s home-grown rival Ola had incorporated the same service in April.

Recommended read:Ola beats Uber in digital payment

UPI or Paytm

However, there has been concerned raised from some quarter paying through UPI, which is not fully efficient. For every transaction on UPI app, there is a SMS authentication process, which can irritate users. Whereas in through Paytm, the number of authentication reduces as it is limited to only in initial stage.

Meanwhile, there is an advantage for user in compare to Paytm option, where user needs to have minimum balance limit of Rs 350. With UPI integration user will be able to book a cab even without balance in account.

Earlier in 2014, Uber tied up with Paytm to offer payment services. The move helped the global cab-hailing firm counter RBI, which made it compulsary for companies to follow a two-step authentication process for credit and card transactions.

Paytm as on date has 165 million users. On transaction count after demonetisation, according to Paytm founder’s Vijay Shekher Sharma , the platform sees 5 million transactions a day.

It will be interesting to see what Paytm will do after one of its big backers offering UPI. Will users shift to UPI or like to contineu with Paytm? This one big question will be revolving in the mind of Paytm, for which answers will be awaited.